Understanding and communicating with Ohio’s Hard-to-Count communities for 2020 Census outreach efforts

As a joint effort, Children’s Defense Fund-Ohio, Innovation Ohio Education Fund and the Ohio Women’s Public Policy Network have put together this document using national messaging guidance, research, and feedback gathered from discussions with leaders, community members, and direct service providers in Ohio’s hard-to-count (HTC) communities across the state.

By combining national messaging guidance from the U.S. Census Bureau and national nonprofits and our own messaging research, we believe the following document provides the best advice and guidance for how to motivate Ohioans to participate in the 2020 Census.

The Children’s Defense Fund-Ohio (CDF) facilitated design-thinking workshops in communities across the state to gain insight into the barriers communities faced to participating in the Census and how we can work to overcome these barriers.

The Ohio Women’s Public Policy Network (WPPN) is a coalition of more than 30 organizations working collaboratively to advocate for public policies that build economic opportunity for women and strengthen families. Considering the large stake women and their families have in the Census and the key role women will play in ensuring a complete count, WPPN conducted listening sessions with their coalition partners to identify the particular concerns and barriers women of all backgrounds in the state expressed.

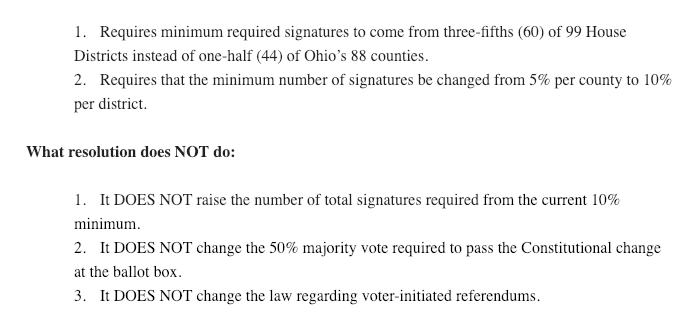

In sum, the Koehler plan would require signatures from more parts of the state, requiring signature gatherers to fan out into 60 of Ohio’s 99 House districts, compared to today’s requirement that signatures be collected in 44 of Ohio’s 88 counties. Additionally, the proposal reduces the number of signatures that could be gathered in Ohio’s biggest population centers by increasing the percentage of the electorate needed in each district, further spreading the work out across the state.

In sum, the Koehler plan would require signatures from more parts of the state, requiring signature gatherers to fan out into 60 of Ohio’s 99 House districts, compared to today’s requirement that signatures be collected in 44 of Ohio’s 88 counties. Additionally, the proposal reduces the number of signatures that could be gathered in Ohio’s biggest population centers by increasing the percentage of the electorate needed in each district, further spreading the work out across the state.