Ohio would be the first state to enact a measure that subsidizes nuclear energy for financial reasons while at the same time eliminating clean energy standards. Make no mistake – Ohio lawmakers are making a deliberate choice to go this route. As noted by Inside Climate News, Connecticut, Illinois, New Jersey, and New York have subsidized nuclear power plants recently, however, those measures bolstered support for clean and renewable energy.

With both parties split on this legislation in the House, it’s not so obvious what political motives are behind some lawmaker’s support for it. This has been sought out by FirstEnergy and its PAC for a while now. Campaign finance records indicate that thousands of dollars were donated by FirstEnergy and its executives to Speaker Larry Householder and his loyalists. The struggling utility company’s former CEO, Anthony Alexander, donated $5,000 each to Householder’s and Rep. Jamie Callender’s (HB6 primary sponsor) 2018 campaign, along with a maximum contribution of $12,707 to Mike DeWine’s campaign. The Governor has come out in support of this bill.

The Cleveland Plain Dealer’s Editorial Board voiced its opposition to the bailout Friday, calling HB6 “a platter of goodies for deep-pocketed special interests who spent liberally — not just in advocating for this legislation but also on Householder’s efforts to get his supporters elected or re-elected to the Ohio House, so they could choose him as speaker.”

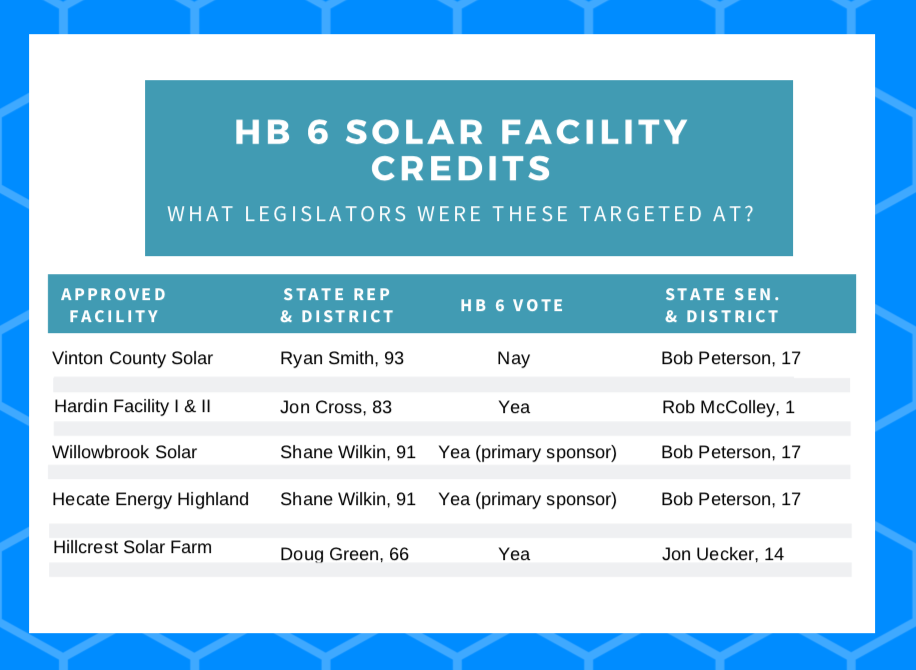

One of the last-minute changes to House Bill 6 was to expand the bill to expand eligibility for the subsidies generated by the bill beyond the state’s two nuclear power plans to large solar facilities. According to the Ohio Power Siting Board, six facilities have been approved that would be eligible under the latest changes to HB6. A look at whose districts those facilities are located in suggests which lawmakers were targeted by the move:

Ohio would be the first state to enact a measure that subsidizes nuclear energy for financial reasons while at the same time eliminating clean energy standards. Make no mistake – Ohio lawmakers are making a deliberate choice to go this route. As noted by Inside Climate News, Connecticut, Illinois, New Jersey, and New York have subsidized nuclear power plants recently, however, those measures bolstered support for clean and renewable energy.

With both parties split on this legislation in the House, it’s not so obvious what political motives are behind some lawmaker’s support for it. This has been sought out by FirstEnergy and its PAC for a while now. Campaign finance records indicate that thousands of dollars were donated by FirstEnergy and its executives to Speaker Larry Householder and his loyalists. The struggling utility company’s former CEO, Anthony Alexander, donated $5,000 each to Householder’s and Rep. Jamie Callender’s (HB6 primary sponsor) 2018 campaign, along with a maximum contribution of $12,707 to Mike DeWine’s campaign. The Governor has come out in support of this bill.

The Cleveland Plain Dealer’s Editorial Board voiced its opposition to the bailout Friday, calling HB6 “a platter of goodies for deep-pocketed special interests who spent liberally — not just in advocating for this legislation but also on Householder’s efforts to get his supporters elected or re-elected to the Ohio House, so they could choose him as speaker.”

One of the last-minute changes to House Bill 6 was to expand the bill to expand eligibility for the subsidies generated by the bill beyond the state’s two nuclear power plans to large solar facilities. According to the Ohio Power Siting Board, six facilities have been approved that would be eligible under the latest changes to HB6. A look at whose districts those facilities are located in suggests which lawmakers were targeted by the move: