What you need to know about Ohio Politics and Policy

Kasich’s oil and gas tax proposal leaves over $1 billion on the table

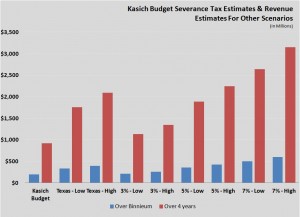

Governor Kasich’s budget raises the rate of Ohio’s severance tax, charged when drillers extract oil and natural gas from Ohio’s shale, but would preserve our tax rate as one of the lowest among all oil and gas producing states. According to the administration, these changes will raise $200 million in new tax revenue over the next two years, but is dwarfed in comparison to the $2.9 billion in new sales taxes Ohioans are being asked to pay in the budget, resources that will support another income tax cut that will mostly benefit the wealthiest Ohioans. It’s important for policymakers to consider whether the new tax rate is sufficient.Based on production estimates from the Ohio Department of Taxation, we attempted to compare the estimated revenue from Governor Kasich’s proposal to what Ohio could collect at varying tax rates, including those in place in other oil and gas states. As shown in the following chart, we used the administration’s forecasts for oil and gas production over the next four years using different severance tax rates that charge a percentage of the market value of the oil and gas. For each tax rate, we looked at what could happen to tax collections in high and low market price scenarios. We also compared Ohio’s proposed rate of 1 percent for natural gas and 4 percent for all other resources to that of Texas, a major oil and gas hub, which charges 7.5 percent and 4.6 percent, respectively, for gas and oil.

Tagged in these Policy Areas: Ohio State Budget