What you need to know about Ohio Politics and Policy

Paying for Ohio income tax cut with revenue from gas patch looking sketchy

Oil and gas development in Ohio is once again going to be a major policy issue in 2013 and Gov. John Kasich intends to push for an increased severance tax on horizontal drilling in Ohio to help pay for a $500 million income tax cut.

While it’s true that the oil and gas industry is growing in Ohio at this time, is it possible that the administration is being overly optimistic in its projection of how many producing wells there will be in the near future? Proper forecasting of wells and production estimates are essential because the production from these new oil and gas wells will pay for Kasich’s income tax cut. That’s why Innovation Ohio was interested in seeing how close the Kasich administration well estimates were to reality in 2012.

Well Estimates

It is critical that the administration properly forecast the number of wells to prevent a budget deficit sometime in the future. If well production estimates are higher than actual production in a year, and wells produce less oil and gas than expected, then the state will collect less tax revenue than it projected. Without the projected revenue the administration will be forced to plug the hole in the budget with resources from other parts of the budget.

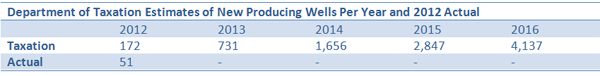

By looking at the administration’s forecast for new well production it is possible to compare their projections against reality and determine how accurate they were. In May of 2012, Policy Matters cited the Ohio Department of Taxation in a report and used the department’s new well projections. The Department of Taxation estimates that by the end of 2012 there will be 172 wells producing and by the end of 2016 4,137 wells will be producing in Ohio.

Oil and gas development in Ohio is once again going to be a major policy issue in 2013 and Gov. John Kasich intends to push for an increased severance tax on horizontal drilling in Ohio to help pay for a $500 million income tax cut.

While it’s true that the oil and gas industry is growing in Ohio at this time, is it possible that the administration is being overly optimistic in its projection of how many producing wells there will be in the near future? Proper forecasting of wells and production estimates are essential because the production from these new oil and gas wells will pay for Kasich’s income tax cut. That’s why Innovation Ohio was interested in seeing how close the Kasich administration well estimates were to reality in 2012.

Well Estimates

It is critical that the administration properly forecast the number of wells to prevent a budget deficit sometime in the future. If well production estimates are higher than actual production in a year, and wells produce less oil and gas than expected, then the state will collect less tax revenue than it projected. Without the projected revenue the administration will be forced to plug the hole in the budget with resources from other parts of the budget.

By looking at the administration’s forecast for new well production it is possible to compare their projections against reality and determine how accurate they were. In May of 2012, Policy Matters cited the Ohio Department of Taxation in a report and used the department’s new well projections. The Department of Taxation estimates that by the end of 2012 there will be 172 wells producing and by the end of 2016 4,137 wells will be producing in Ohio.

Because the actual number of producing wells is so far behind administration estimates this significantly increases the pressure on production forecasts for 2013 and beyond. The small number of producing wells in 2012 means that either oil and gas producers need to get producing wells on line at a faster rate than projected or the administration needs to rethink the math on how much tax revenue they can realistically expect to collect in the near term from these wells.

Without stronger growth in the number of producing wells in the next two years, the idea of paying for an income tax cut with severance tax revenue will be close to impossible. According to our analysis of Department of Natural Resource data, only 51 horizontal wells were producing by the end of 2012 in the Utica and Marcellus shale plays. This number is significantly less than the 172 wells Taxation projected would be producing by the end of 2012 and calls into question the accuracy of their remaining projections.

Lawmakers over the next several months will be debating the state’s operating budget in which Kasich will ask to include a permanent income tax cut and pay for it with severance tax revenue. It is critical that lawmakers make sure that the administration’s proposals are not built upon pie-in-the-sky estimates about oil and gas production over the next several years. Otherwise it is likely lawmakers will once again find themselves with a structurally deficient budget in the not too distant future.

Because the actual number of producing wells is so far behind administration estimates this significantly increases the pressure on production forecasts for 2013 and beyond. The small number of producing wells in 2012 means that either oil and gas producers need to get producing wells on line at a faster rate than projected or the administration needs to rethink the math on how much tax revenue they can realistically expect to collect in the near term from these wells.

Without stronger growth in the number of producing wells in the next two years, the idea of paying for an income tax cut with severance tax revenue will be close to impossible. According to our analysis of Department of Natural Resource data, only 51 horizontal wells were producing by the end of 2012 in the Utica and Marcellus shale plays. This number is significantly less than the 172 wells Taxation projected would be producing by the end of 2012 and calls into question the accuracy of their remaining projections.

Lawmakers over the next several months will be debating the state’s operating budget in which Kasich will ask to include a permanent income tax cut and pay for it with severance tax revenue. It is critical that lawmakers make sure that the administration’s proposals are not built upon pie-in-the-sky estimates about oil and gas production over the next several years. Otherwise it is likely lawmakers will once again find themselves with a structurally deficient budget in the not too distant future.

Tagged in these Policy Areas: