2018 is an important election year–one in which Ohioans will choose a new Governor for the first time in eight years. During that time, Ohio’s economy has been rapidly changing and the future only promises yet more change. The next Governor will inherit an enormous opportunity to enact policies that can have a profound impact on how the people and economy of our state adapt for the future.

For that reason, our educational arm, Innovation Ohio Education Fund, teamed up with Policy Matters Ohio to produce our first joint work product: A Winning Economic Agenda for Ohio’s Working Families. This tool represents a set of proactive policies that the state’s incoming Governor and their legislative partners can use as a guide to help them effectively meet future challenges and ensure the economy works for everyone.

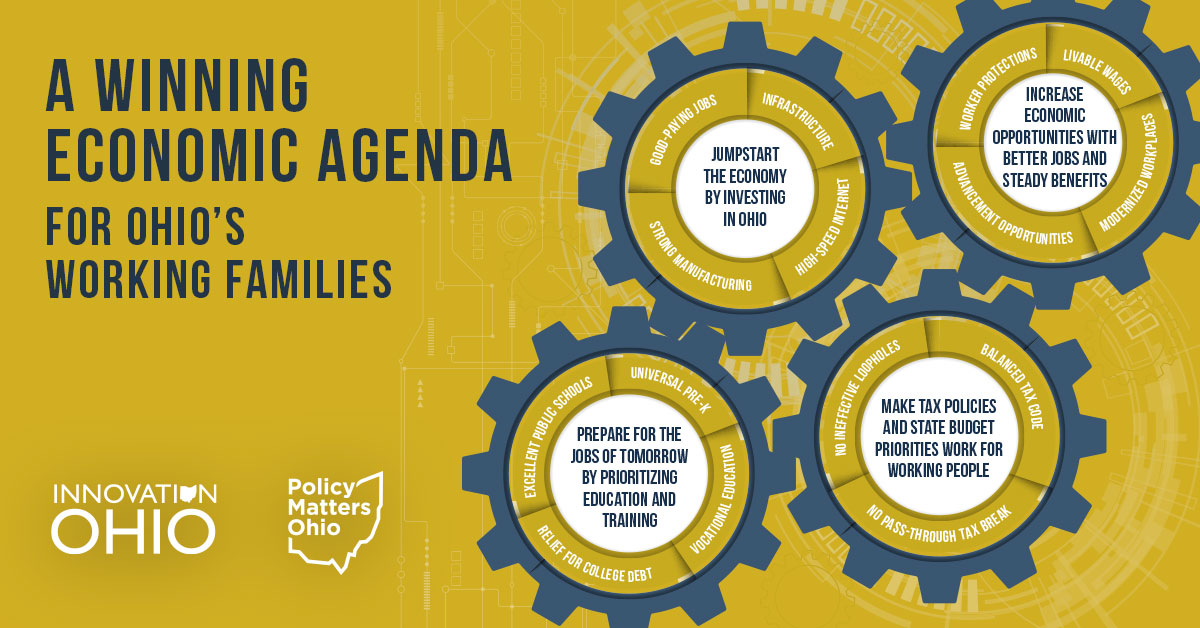

The Agenda involves four major efforts, namely:

2018 is an important election year–one in which Ohioans will choose a new Governor for the first time in eight years. During that time, Ohio’s economy has been rapidly changing and the future only promises yet more change. The next Governor will inherit an enormous opportunity to enact policies that can have a profound impact on how the people and economy of our state adapt for the future.

For that reason, our educational arm, Innovation Ohio Education Fund, teamed up with Policy Matters Ohio to produce our first joint work product: A Winning Economic Agenda for Ohio’s Working Families. This tool represents a set of proactive policies that the state’s incoming Governor and their legislative partners can use as a guide to help them effectively meet future challenges and ensure the economy works for everyone.

The Agenda involves four major efforts, namely:

- Jumpstart the Economy by Investing in Ohio

- Increase Economic Opportunities With Better Jobs And Steady Benefits

- Prepare for the Jobs of Tomorrow by Prioritizing Education and Training

- Make Tax Policies And State Budget Priorities Work For Working People

Read it here: A Winning Economic Agenda for Ohio’s Working Families.

We invite everyone – whether you hold office, are a candidate for one or just advocate for better public policy – to scan through the winning agend and work with us as we make a case for proactive and progressive changes at the state level to better position Ohio and its workers for a bright economic future.

Over the coming months we will add more detail to each section, identifying the impact of doing nothing as well as best practices and justification for change.

If you have a story about how better public policy could improve your life or that of your family, let us know.

Download a copy of A Winning Economic Agenda for Ohio’s Working Families.

Read it here: A Winning Economic Agenda for Ohio’s Working Families.

We invite everyone – whether you hold office, are a candidate for one or just advocate for better public policy – to scan through the winning agend and work with us as we make a case for proactive and progressive changes at the state level to better position Ohio and its workers for a bright economic future.

Over the coming months we will add more detail to each section, identifying the impact of doing nothing as well as best practices and justification for change.

If you have a story about how better public policy could improve your life or that of your family, let us know.

Download a copy of A Winning Economic Agenda for Ohio’s Working Families.