What you need to know about Ohio Politics and Policy

10 Ways Ohio’s Leaders Could Increase Take Home Pay for All Ohioans

Sub-Report of “A Winning Economic Agenda for Ohio’s Working Families”

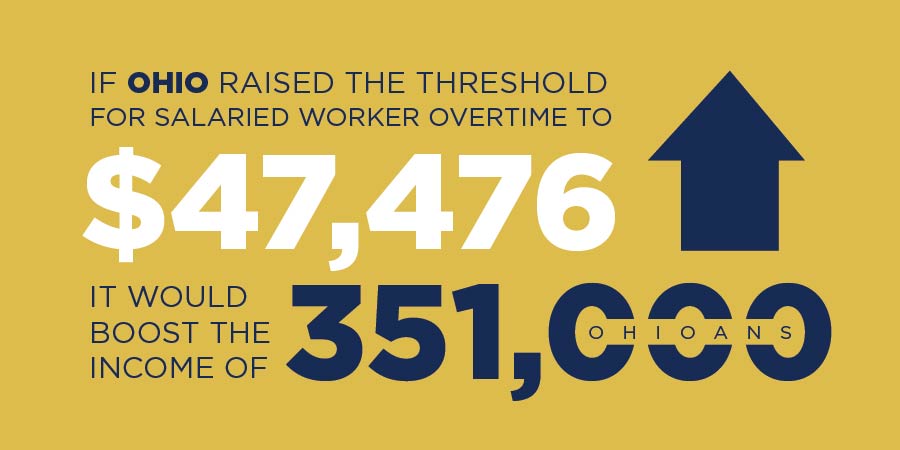

For too long, Ohioans’ wages have remained stagnant, while politicians have enacted policies that take more money away from an employee’s bottom line. Hard-working families are struggling to keep up and their jobs no longer guarantee them basic protections in the workplace we once valued as a state. The growing inequality and dwindling focus on fairness means our social contract is hanging on by a thread. Families no longer have the guarantee of economic security. By enacting policies that end employee exploitation and raise wages, our government could ensure Ohioans get to keep more of what they earn in their pocket and are ensured a comfortable and secure life. Below are 10 changes Ohio’s policymakers could make to state policy that would raise wages and the standard of living for all Ohioans.1) Every day, Ohioans are losing $123,000 in wages because of their lack of eligibility for overtime pay, resulting in $45 million in lost wages every year. Too many Ohio workers are not being compensated for the long hours they work day in and day out.

The salary level at which workers are eligible for overtime pay hasn’t budged since the Bush administration. If Ohio would raise the threshold for salaried worker overtime to $47,476, this would boost the income of 351,000 Ohioans. These Ohioans are working long days for no extra pay, but this change could vastly alter their earnings and ensure their wages match their labor input.

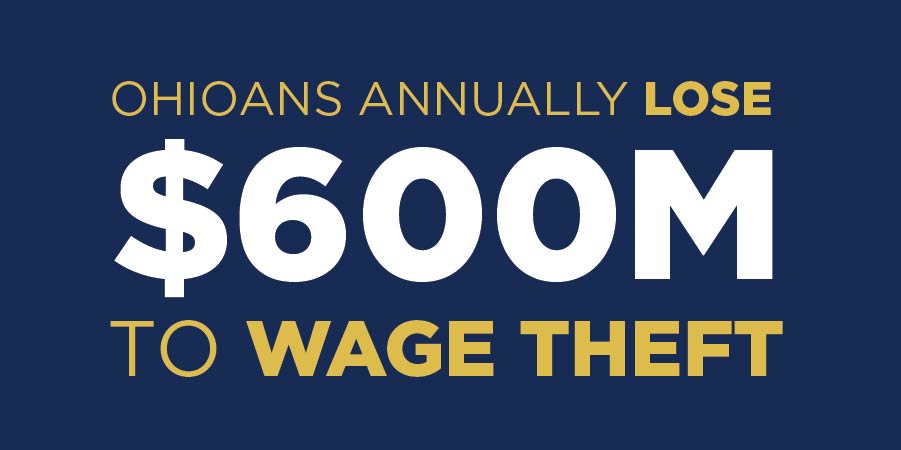

2) Ohio has the second largest share of workers who are victims of minimum wage violations, according to a report by the Economic Policy Institute, estimating that Ohioans annually lose $600 million to so-called “wage theft”. Despite this rampant abuse by employers, Ohio has cut staff in the departments responsible for protecting the workers of Ohio. The state currently has only six wage and hour investigators, one for every 795,883 private-sector workers.

By investing in enforcement of wage and hours laws for employees and ensuring this enforcement is targeted to low-wage sectors where it runs rampant, we could protect the nearly 23 percent of low-wage workers who are not receiving their full compensation for their hard work.

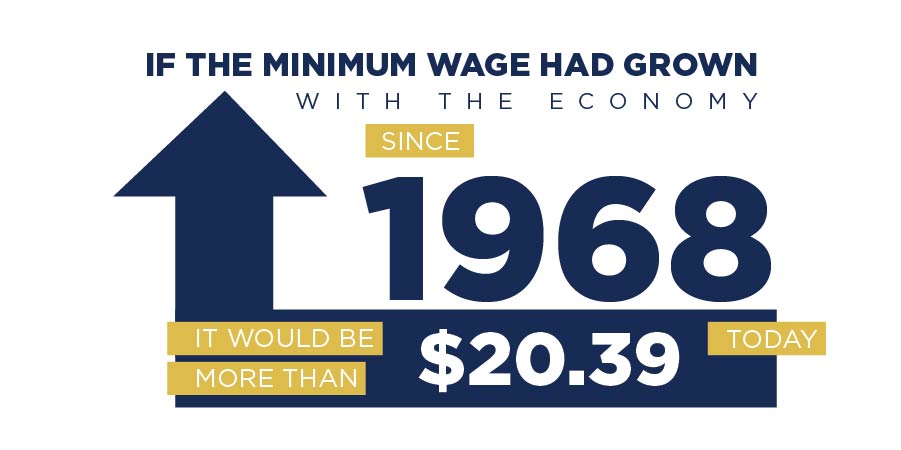

3) Ohio’s economy has grown 65 percent in the last generation, but the same cannot be said for its wages. If the minimum wage had grown with the economy since 1968, it would be more than $20.39 today. However, minimum wage currently rests at just $8.30 an hour. This means that for a family of three with one parent working full time at minimum wage, they are earning $3,500 below the poverty line. This minimum wage is not enough to support a family, let alone an individual person.

To reflect the rise in production and education of our workforce, Ohio should raise the minimum wage to $15 by 2025. This wage would better care for Ohioans and their families.

4) In Ohio, unionized workers make $4 an hour more than their non-union counterparts. Aside from increase in wages, these workers also enjoy health insurance, a pension and paid sick days.

Instead of enacting so-called “right-to-work” legislation that strips workers of their bargaining rights, Ohio policymakers should be supporting and aiding employees’ ability to join or form unions. This ensures higher wages and better protections for all.

5) On average, women in Ohio earn only 75 cents for every dollar Ohio men make, creating an annual wage gap of $12,686. This loss of equal wages hurt women in both the short term and long term.

Ohio policymakers need to enact policies that promote pay equity. These would include policies that strengthen enforcement of pay discrimination, close employer loopholes in laws, eliminate the practice of asking for salary history, and prevent retaliation against an employee who discusses salaries or wages.

6) Too often, employers are classifying workers as independent contractors, denying them eligibility for benefits including health insurance, workers compensation, traditional tax withholding, and unemployment benefits, when they are, in fact, for all intents and purposes, treated like employees in all other facets. Genuine contracting provides a great deal of freedom and flexibility for motivated talent, but if your hours and work are dictated by the company you’re working for, then you’re an employee, and should be eligible for full benefits. This is called “misclassification” and it is illegal.

Contractors are exploited and businesses are able to bypass the requirements of the Federal Fair Labor Standards Act. This has an adverse impact on these employees bottom line and their wages go towards protections their employers should be providing. To offer better protection against exploitation, policymakers should clarify and simplify Ohio’s misclassification of contractors by instituting a 7-part test that is simple and matches the modern workplace.

7) For hourly and shift workers across Ohio, work hours and take home pay can vary with each new week. For those pursuing higher education, it becomes difficult to schedule classes, and for working parents, nearly impossible to arrange childcare. This unpredictability, paired with the possibility of being sent home without pay during shifts you were scheduled to work, or being penalized for requesting adjustments to your work schedule, means shift workers face a unique form of economic burden.

By passing “fair scheduling” legislation, Ohio could join the growing number of states and localities that defend the quality of life for low-wage workers. Fair scheduling legislation would include workers receiving their schedule two weeks in advance, predictability pay if the schedule is changed without seven days’ notice, a good-faith estimate of the number of shifts or hours a worked can expect per month, require employers to offer part-time employees the chance to cover extra hours before hiring new employees, and require that, if a company is sold, the new employer must retain tenured employees for a 90-day transition period.

8) When the State of Ohio functions as an employer, contractor, an investor or purchaser, attention should be paid to the job quality and standards of the companies it works with. All State workers and contractors–whether hired directly or indirectly– should earn decent wages and benefits and, when purchasing goods, preference should be given to Ohio vendors employing Ohioans to do the work.

Additionally, when Ohio contracts work out to private businesses, we need to be attentive to the job quality and labor standards of the service provider. State policy must recognize that the resources we invest not only provide services, but also good jobs for Ohio’s families. Ohio’s government should be the model of providing good paying jobs, not the case study of failed privatization and tax policies.

9) Ohio currently offers no refundable tax credits for working class people. Two simple changes to Ohio’s tax structure could dramatically alter the livelihood for poor and middle-income families and put more of what they earn back in their pockets.

By creating a sales-tax credit for taxpayers, Ohio could stimulate consumer spending and the local economy, while offsetting the shift in Ohio from income taxes to sales taxes. We estimate that a sales tax rebate would have returned on average $106 to eligible low-income families in 2016. Additionally, Ohio should remove the cap on the Earned Income Tax Credit and make it refundable. This credit helps working people take care of their families, but now is limited to families in a narrow income band.

10) The average cost to borrow $300 in Ohio is $680 over five months. In today’s low-wage economy, many working people have few options when they need emergency cash.

Recently the Ohio House passed measures that would improve regulation of so-called “payday lenders”, but we need to go further to ensure that Ohio workers to not fall victim to these debt traps. H.B. 123 closes loopholes in the Short-Term Lender Law, which Ohio voters overwhelmingly supported in 2008. Now the bill is in the Ohio Senate, where it is subject to possible amendments. However, via loopholes, predatory lenders can license themselves under the Ohio Mortgage Lending Law or the Ohio Small Loan Act, avoiding the regulations and consumer protections. It is time Ohio closed these loopholes and ensure working families are protected from these debt traps.

You can read Innovation Ohio Education Fund’s and Policy Matters Ohio’s full policy agenda here: A Winning Economic Agenda for Ohio’s Working Families.

Tagged in these Policy Areas: