Ohio’s State Budget Bill – Exploding Vouchers, Lax Charter School Oversight

Exploding Vouchers. Returning to Pre-ECOT Oversight of Charter Schools.

EXECUTIVE SUMMARY

The July passage of House Bill 166, the state’s two-year operating budget for fiscal years 2020 and 2021, signaled a disturbing return to the lax oversight of Ohio’s charter school system that led to a massive taxpayer scandal, as well as a continued expansion of the transfer of taxpayer funds from public to mostly-religious private schools.

When Governor Mike DeWine signed HB166 into law, he approved a budget that lawmakers had packed full of little-noticed gifts to those who seek to erode support for traditional public schools through a proliferation of charter and private school options funded at taxpayer expense.

The budget bill included four major gifts to the school choice crowd, namely:

1. Weakening Ohio’s Automatic Charter School Closure Law

2. Weakening Standards for Dropout Recovery Schools

3. Weakening Oversight of Charter School Sponsors

4. Increasing the Transfer of Taxpayer Dollars To Private Schools Via Vouchers

The voucher expansion alone, if fully adopted, could cost Ohio districts at least another $73 million over the biennium1, on top of an already ballooning $389 million per year private school voucher program.

Innovation Ohio’s latest analysis looks at how the state budget expands the state’s already exploding voucher program while reversing progress to bring accountability to charter schools.

Ohio’s State Budget Bill

Exploding Vouchers / Returning to Pre-ECOT Oversight of Charter Schools

House Bill 166, the state’s two-year operating budget for fiscal years 2020 and 2021, heralded a return to the lax oversight of Ohio’s charter school system that led to a massive taxpayer scandal, and a continued expansion of the transfer of taxpayer funds from public to mostly-religious private schools. Innovation Ohio is concerned that with this return to weaker oversight of and greater investment in education privatization options, scandals like the one that brought down the Electronic Classroom of Tomorrow (ECOT) will become the norm, and more and more taxpayer dollars will continue to flow to unaccountable, mostly-religious private schools.

Charter Schools: Less oversight of a scandal-ridden sector

In early 2018, ECOT, at the time, the state’s largest online charter school, was forced to close after 18 years in operation after the state sought to recover $124 million the school charged taxpayers for kids they couldn’t prove were actually participating in online learning. Since the school’s first year of operation in 2000-2001, Ohio officials knew that ECOT’s ability to track students was suspecti. But little to nothing was done, in large part because the school’s founder and for-profit operator, William Lager, contributed huge amounts of cash to the campaign accounts of Ohio politicians, primarily Republicansii.

Despite the passage of House Bill 2 in 2015 – a landmark charter school oversight bill that in many ways brought Ohio back closer into the national mainstream on charter school oversight – the law did not go far enoughiii to rein in the sector once dubbed the “Wild, Wild West of Charter Schools” by national pro-charter advocatesiv.

Rather than building on that effort at accountability, the FY2020-21 Budget Bill signed into law by Gov. DeWine actually weakened oversight of Ohio’s charter school sector and helped some of the worst-performing schools in the nation remain open. Here’s how:

• Changes current rules for automatically closing failing charter schools

• Makes it easier for failing Dropout Recovery Schools to remain open

• Allows charter school sponsors to have a do-over on their state evaluations

Weakening Ohio’s Automatic Closure Law

When the state’s automatic closure law was first adopted in 2005, it required three consecutive years of failure as a standard (for non-high schools)v. However, in 2009, then-Gov. Ted Strickland and the Ohio House successfully updated that to a more stringent 2 out of 3 yearsvi.

To be clear, even with the tougher standard, the state’s automatic closure law has had a very small impact on closing bad charter schools, primarily because the state kept exempting charters from the requirements by changing the report card and testing regime multiple times over the last 10 years. According to state datavii, of 305 charter schools that have closed in Ohio, only 24 did so because of the closure law. By comparison, 172 closed voluntarily. Another 80 were ordered closed for primarily financial reasons. Prior to the closure law, six charters closed for failing to meet basic legal requirements.

All told, Ohio’s closure law (which charter school proponents have called the toughest in the nationviii) is now being loosened because as many as 52 charters would other be subject to closure under the current standardix. To which we would argue: “exactly”. When more than half of all students going to charters attend schools that perform the same or worse than the district schools they would otherwise attend,x one would think that losing 52 of the worst performers would be a good thing, and it would make more funding available for higher performers.

Interestingly, of the 52 charters2 that were scheduled to be closed under the old standard, 34 are run by for-profit charter school operators, including almost 20 percent of the former White Hat schools now being operated by Ron Packard – the founder of K-12, Inc. – the nation’s largest (and most notoriousxi) online charter school operator. Another big operator set to take a hit was J.C. Huizenga’s 10 Ohio-based National Heritage Academies. Six of those were on the chopping block before the legislature offered a legislative reprieve. Huizenga is an acolyte of Betsy DeVos – the controversial U.S. Secretary of Education – and his political connections have kept his schools afloat for years, despite complaints from the schools they ran about performancexii.

National Heritage has been a darling of pro-charter school advocates over the years, with the Fordham Institute declaring them last year a “notable example of a high-performing for-profit charter chain.”xiii It would seem to burst the charter-school myth that if the poster child for “high performing, for-profit charter schools” had to close 60 percent of its Ohio schools for poor performance.

Instead, Ohio lawmakers have once again moved the goalposts on charter school accountability, helping for-profit charter school operators, and continuing to allow the worst performing charter schools to remain open and fail students for another year. We struggle to understand the public policy reasons for allowing this to continue, especially in light of the ECOT scandal, in which that school (thanks to its deep political ties) was allowed to fail students for two decades.

Weakening Dropout Recovery School Standards

Ohio’s dropout recovery schools – charter schools designed specifically to return dropouts to the state’s school system – are, simply put, among the worst-performing schools in the entire nation. Some graduate less than two percent of their students in four years and less than 10 percent in eight years. The state’s already lax standards only requires that a dropout recovery school graduate eight percent of their students in four years.

In order to remain open, students in these schools must pass a test to ensure academic standards are met. The FY2020-21 state budget allowed dropout schools to adopt another, easier test, and reduced the passing score, which the non-partisan Legislative Service Commission predicted “may increase the number of dropout prevention and recovery community schools rated as ‘exceeds standards’ or ‘meets standards’” and “may reduce the number of dropout prevention and recovery community schools subject to closure.”xiv

Last year, of the 6,887 students in dropout recovery schools eligible to have graduated within four years, only 1,808 actually did. Meanwhile, in Ohio’s major urban districts (Akron, Canton, Cincinnati, Columbus, Cleveland, Dayton, Toledo and Youngstown), more than 75 percent of students graduate within 4 years.

Weakening Charter School Sponsor Oversight

The result of having fewer poor performing charter schools is that charter school sponsors – which can collect as much as 3 percent of a charter school’s state funding to oversee the school – will see their evaluations weakened. To make matters worse, the Budget Bill orders the Ohio Department of Education to re-evaluate sponsors’ previous accountability ratings to take into account these new, weaker dropout recovery standards. As a result, these sponsors will get a do-over on their previously-failing oversight grades.

The main accountability provision in House Bill 2, enacted in 2015,3 was to make life more difficult for sponsors – many of whom are not education entities – and create more incentives for them to provide oversight of an out-of-control charter school sector. Allowing sponsors to re-do their past evaluations greatly weakens the oversight the state can exert over the overseers, allowing for the possibility of more ECOT-like scandals to proliferate and rob Ohio taxpayers of resources that could be better spent in traditional public school buildings or higher-performing charter schools.

Voucher Explosion

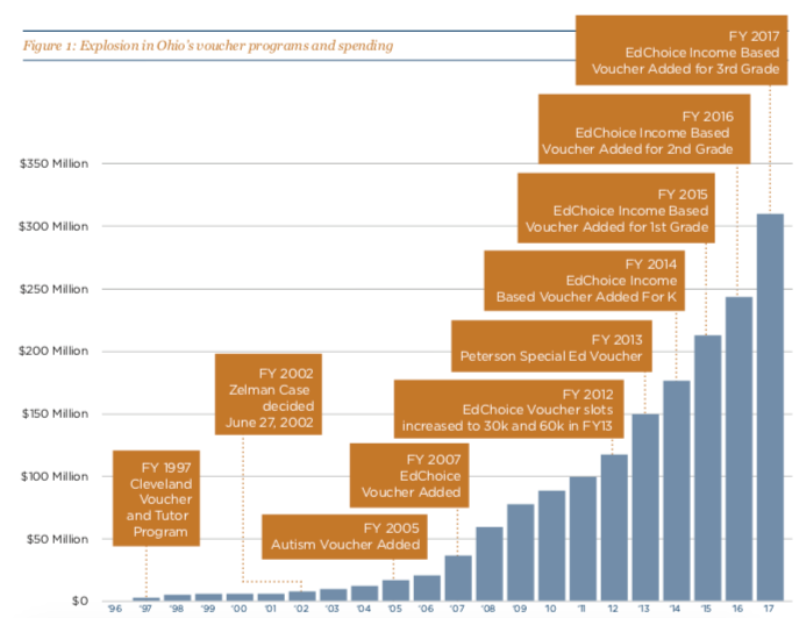

Ten years from now, it’s not impossible to imagine that we’ll look back at HB166 as the “Voucher Bill,” thanks to the massive expansion of vouchers the budget bill will infuse into the system. This is thanks primarily to the bill’s $73.3 million annual expansion of the EdChoice Expansion program – an income-based voucher that any child who meets an income requirement can take to have taxpayers subsidize their private (and in most cases religious) education. In terms of scale, 10 years ago, all voucher deductions put together was only $56 millionxv.

While it may seem like a sympathetic idea to provide low-income children an opportunity to access private school education, the issue is that under the expansion, families of four earning up to $103,000 now qualify for a nearly $3,000, taxpayer funded, public subsidy to offset their private-school tuitionxvi. It is estimated that nearly 80 percent of Ohio households would qualify for at least half of the full voucher amountxvii.

This is just the latest in a series of expansions of vouchers in Ohio law. The state has been on the front lines of the private school voucher fight for two decades.

In 2001, the U.S. Supreme Court case ruled the Cleveland voucher program—at the time, the only private school voucher program offered in the state—constitutional, despite the fact that it sent public tax dollars to private, mostly religious schools. This was because, as stated in the opinion written by then-Chief Justice William Rehnquist, “[a]ny objective observer familiar with the full history and context of the Ohio program would reasonably view it as one aspect of a broader undertaking to assist poor children in failed schools.”xviii The ruling found the program was limited in scope and costs; therefore, it wasn’t an overly burdensome infringement on the Establishment Clause of the U.S. Constitution.

Times have changed. What was once a single program in one city that cost taxpayers $2.9 million has become a more than $333.8 million annual venture, with 581 of the state’s 610 school districts losing at least one student to vouchers over the last 5 years. The growth of these programs will likely accelerate under HB 166. Private school vouchers are now impacting 95 percent of Ohio school districts—certainly not all of which are failing.

Originally created to help students in poor-performing Cleveland schools, the number of voucher programs has steadily grown to include 5 different voucher programs, making even more students around the state eligible. By the 2006-2007 school year, nearly a third of Ohio’s 613 school districts saw some students opting to attend private schools using taxpayer-funded vouchers. Today, vouchers impact 95 percent of school districts.

In addition, the amount of state money given per voucher has exploded since the Supreme Court ruled that its small amount compared with public schools meant it didn’t violate the Establishment Clause. Between 2002 and today, the average per pupil voucher has grown from just over $1,300 to $6,512 per student, adjusted for inflation. Meanwhile, the state’s per pupil public school investment has seriously lagged that of its private school counterparts going up from $4,100 to $4,782 in inflation adjusted dollars during the same period.

The state investment in private, mostly religious schools now far surpasses, on average, the state’s average per pupil investment in the 1.7 million Ohio students who attend Ohio’s public school districts. This reversal calls into question whether today’s voucher system in Ohio would survive the same legal analysis that justified the program in 2002.

It is also troubling that the state has chosen to increase its investment of taxpayer money in private, mostly religious schools by 428% since 2002, while at the same time only delivering a 12% increase in state per pupil investment in public school districts. It probably isn’t a coincidence that 2002 also saw the Ohio Supreme Court end its examination of Ohio’s school funding system. Those two decisions – one from the U.S. Supreme Court allowing for vouchers to be done and one from the Ohio Supreme Court giving up its oversight of Ohio’s school funding system, which it had ruled four different times to be unconstitutional – led to the state deciding to increase funding to vouchers by 400 percent and essentially freeze school district funding.

As can be seen in the following table showing funding for the state’s five voucher programs for the four years beginning in 2013-2014 and ending with 2017-2018 school year, millions of dollars have been sent to private, mostly religious schools from every type of school district in the state, not only from the major urban districts. In fact, just under half of the money sent out to voucher programs did not come from major urban districts.

| District Type | EdChoice Expansion | Autism Voucher | Special Ed Voucher | EdChoice Voucher | Original Cleveland Voucher |

|---|---|---|---|---|---|

| Poor Rural | $ 4,673,702 | $12,220,320 | $ 6,059,308 | $ 78,060 | $ – |

| Rural | $ 2,515,709 | $ 8,305,086 | $ 4,532,842 | $ 33,143 | $ – |

| Small Town | $ 7,535,697 | $ 24,120,479 | $ 15,117,235 | $ 190,250 | $ – |

| Poor Small Town | $ 17,069,071 | $ 28,652,804 | $ 19,851,275 | $ 5,844,387 | $ 3,740 |

| Suburban | $ 20,200,635 | $ 78,416,765 | $ 52,421,563 | $ 8,410,821 | $ 121,540 |

| Wealthy Suburban | $ 4,389,589 | $ 66,196,920 | $ 33,634,223 | $ 201,652 | $ 54,103 |

| Urban | $ 27,263,416 | $ 61,046,676 | $ 24,136,553 | $ 93,178,052 | $ 847,472 |

| Major Urban | $ 25,402,368 | $ 65,205,127 | $ 40,433,321 | $ 346,571,689 | $ 166,142,550 |

| Grand Total | $ 109,050,188 | $ 344,164,177 | $ 196,186,321 | $ 454,508,052 | $ 167,169,405 |

Based on earlier expansions, the $73.3 million additional funding set aside in House Bill 166 for income-based vouchers will result in funding losses across all sectors of Ohio’s school system. This becomes a problem because as students depart public schools using vouchers, the school districts they leave behind see their state resources decline accordingly, forcing them to dig into local resources (or cut programming) to make up the difference. This impacts some of the highest-performing school districts in the state – a far cry from the 2002 claim that vouchers are meant to help poor kids escape failed schools.

| District Name | County | Local Subsidy (2014-2018) |

|---|---|---|

| Columbus City School District | Franklin | $ 28,015,593 |

| Cincinnati City School District | Hamilton | $ 20,314,389 |

| Cleveland Hts-Univ Hts City School District | Cuyahoga | $ 8,859,655 |

| Olentangy Local School District | Delaware | $ 7,955,472 |

| Worthington City School District | Franklin | $ 7,413,205 |

| Hilliard City School District | Franklin | $ 7,110,616 |

| South-Western City School District | Franklin | $ 6,751,052 |

| Westerville City School District | Franklin | $ 6,135,993 |

| Dublin City School District | Franklin | $ 6,056,282 |

| Northwest Local School District | Hamilton | $ 5,928,916 |

| Parma City School District | Cuyahoga | $ 5,240,310 |

| Lakota Local School District | Butler | $ 4,983,578 |

| Boardman Local School District | Mahoning | $ 4,817,835 |

| Oak Hills Local School District | Hamilton | $ 4,493,305 |

| Fairfield City School District | Butler | $ 3,508,264 |

| Gahanna-Jefferson City School District | Franklin | $ 3,174,098 |

| Mayfield City School District | Cuyahoga | $ 2,915,948 |

| South Euclid-Lyndhurst City School District | Cuyahoga | $ 2,863,618 |

| Sycamore Community City School District | Hamilton | $ 2,700,666 |

| Newark City School District | Licking | $ 2,632,417 |

It would be one thing if vouchers provided clearly better opportunities for students. However, the Thomas B. Fordham Institute – a pro-school choice advocacy research outfit – recently examined Ohio’s largest voucher program and found that voucher students didn’t do better or the same as their public school counterparts. They did worse.xix

As the report put it, “The students who used vouchers to attend private schools fared worse on state exams compared to their closely matched peers remaining in public schools.” Even in Cleveland — an often ridiculed district by school choice advocates — vouchers were found to not substantially improve the performance of the students who utilized them.xx

This supports other research indicating that controlling for demographics, public schools overall do better than their private school competitors.xxi

Overall, this budget would seem to expand the state’s investment in taxpayer investment in privately run educational options. And that’s on top of an estimate record $1.2 billion spent on them last school year4, according to Ohio Department of Education data.

What is interesting is that while charter funding dropped slightly after ECOT and a few other charter schools closed, voucher funding has increased at a greater rate. Given the state’s wholesale infusion of voucher money this budget cycle, it’s not impossible to envision a time when voucher funding may approach or even overtake charter school funding totals.

Conclusion

In short, the state budget made it easier for schools like ECOT to continue to scam the Ohio taxpayer, all while public investment grows in private, mostly religious schools with almost zero accountability for those tax dollars and who have been demonstrated to harm student performance.

Endnotes

i https://www.dispatch.com/news/20180121/ecot-endured-despite-years-of-warning-signs

ii https://www.dispatch.com/news/20180511/with-notable-exceptions-politicians-scurry-to-give-up-ecot-contributions

iii https://innovationohio.org/2015/10/14/hb-2-passes-now-to-the-details/

iv https://www.cleveland.com/metro/2014/07/ohio_is_the_wild_wild_west_of.html

v http://education.ohio.gov/getattachment/Topics/Community-Schools/Annual-Reports-on-Ohio-Community-Schools/Community-School-LegisHistory.pdf.aspx

vi https://www.lsc.ohio.gov/documents/budget/128/MainOperating/FI/CompareDoc/EDU.pdf

vii http://education.ohio.gov/getattachment/Topics/Community-Schools/Sections/Public-Documents-and-Reports/List-of-closed-schools-and-the-reason-for-closure.xlsx.aspx?lang=en-US

viii https://www.ohio.com/article/20130906/NEWS/309068868

ix https://fordhaminstitute.org/ohio/commentary/three-and-out-ohio-should-rework-its-automatic-charter-closure-policy

x https://knowyourcharter.com/wp-content/uploads/2017/10/CharterReport_Oct2017.pdf

xi https://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html

xii https://www.huffpost.com/entry/why-is-this-charter-schoo_b_5397059

xiii https://fordhami

xiv https://www.lsc.ohio.gov/documents/budget/133/MainOperating/FI/CompareDoc/EDU.pdf

xv http://odevax.ode.state.oh.us/htbin/WWW-SF3-HEADER-F2009.COM?act=Final+%233%28Paid+07-May-2010%29&irn=045187+Ada+Ex+Vill+SD+%28Hardin%29&county=01+Adams&DISTRICT=TOTAL&edch=y

xvi https://education.ohio.gov/getattachment/Topics/Other-Resources/Scholarships/EdChoice-Scholarship-Program/ExpansionIncomeChart.pdf.aspx?lang=en-US

xvii https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=CF

xviii Zelman v. Simmons-Harris, 536 U.S. 639 (2002)

xix https://edexcellence.net/publications/evaluation-of-ohio%E2%80%99s-edchoice-scholarship-program-selection-competition-and-performance

xx http://education.ohio.gov/Topics/Other-Resources/Scholarships/EdChoice-Scholarship-Program/EdChoice-Cleveland-Assessment-Data

xxi http://www.theatlantic.com/education/archive/2013/10/are-private-schools-worth-it/280693/

Innovation Ohio Statement on Charter School Provisions in Operating Budget

New Proposal Adds $718M For Ohio School Districts

Transportation Talks Deadlocked

The House and Senate remain deadlocked on how much to raise the state’s gas tax after blowing through their weekend deadline to fund the Department of Transportation. Both chambers passed smaller tax increases than Governor DeWine requested, but on Friday, the House and Governor reached a deal for an 11-cent increase. Senate Republicans, who already passed a 6-cent tax increase say that’s too much, so talks continue. The two sides did agree to a major increase in spending on public transit — up from $40 million to $70 million annually. The gas tax (and whether there will be electric vehicle fees or a front license plate requirement) still needs to be worked out, hopefully in a conference committee meeting happening today at 1pm.Proposed Funding Plan Would Add $718 Million For Ohio School Districts

The Fair School Funding Plan is out, and with it are the simulations showing how much additional revenue school each district in the State would get in the first two years of its phased-in implementation. The plan would base funding for schools on the actual cost of providing an education, factoring in the ability of the district to raise money locally, and adding additional funding for high-poverty, gifted, special ed and English language learners. By year 2, the plan would increase school district funding by $718 million, while creating a separate line item to directly fund charter schools, a major win for public school advocates. No district loses money under the plan, but some districts see no new revenue, largely to hold them harmless if the new formula says they should lose funding due to shrinking enrollments. More hearings and tweaks are expected as the plan is considered in parallel to the state budget (HB166). If it becomes part of the budget plan, lawmakers will need to find additional revenue to fund it, something we’ve been very clear is needed On the budget itself, this week subcommittees continue hearing agency testimon, with an opportunity for public testimony expected next week. You can see all our budget updates and analysis, as well as outside news and editorial opinions on our new new Budget Central website.Gas Tax Crunch Time and A School Funding Plan

Final Week of Work on Governor DeWine’s Transportation Proposals

The transportation budget—and with it, an increase in Ohio’s gas tax to fund roadwork and a boost for public transit—goes into the homestretch this week. A House-Senate conference committee will be appointed to work out differences between the DeWine proposal and the House and Senate versions of the bill. The 6-member conference committee will be made up of 4 Republican and 2 Democrats (2 of the former and 1 of the latter from each legislative chamber), with Reps Oelslager, Greenspan and Cera likely to be joined by Senators Hottinger, Dolan and Antonio.Unlikely Allies?

Typically, such a lopsided committee makeup leads to many items being approved on a 4-2 vote along party lines. This time could be different. The House version of the budget, which reduced DeWine’s 18-cent gas tax increase to 10.7-cents and increased transit funding to $100 million was approved by a wide, bipartisan margin. The Senate version, with its 6-cent gas tax increase and $55 million for transit, passed largely along party lines. There’s a not-insignificant chance we could see House Republicans team up with both Democrats to push through a final package that looks closer to the House version. Whatever they come up with, it must be approved by both chambers by the end of the week in order to get a final package to Governor DeWine in time for the March 31 signing deadline.Testimony Begins on DeWine’s Two-Year Operating Budget

The operating budget had its first week of testimony in the House Finance committee last week. The biggest news of the week was the $700 million gap between the revenue estimate produced by the DeWine budget office and that of the General Assembly. If lawmakers stick with their own estimate, DeWine’s spending proposals – already too modest in our opinion – will need to be trimmed by $700 million, and that’ before any new spending is added.Sources of New Revenue

Unsurprisingly, this week we heard Finance committee members asking the DeWine administration about its decision to preserve the $1.3 billion small-business tax break known as the “LLC Loophole.” The gimmick, created by Gov. Kasich in 2013, allows certain pass-through business owners take home their first $250,000 in earnings tax free, but has not been shown to have any impact on job creation. Another revenue-raiser the House may consider is applying Ohio’s sales tax to internet sales from out-of-state shippers. The Tax Department told committee members last week that this proposal could generate $350 million or more in annual revenue for the state.Agencies Defend Their Budgets

We still don’t have a bill number (or bill language!) for the DeWine budget, but that doesn’t stop it from moving to the subcommittees of House Finance, where various licensing boards and commissions will make their funding pitches to lawmakers this week. Among those testifying will be representatives from the Governor’s Office, Attorney General, Secretary of State, Auditor and Treasurer, as well as the Ethics Commission, Commission on Minority Health and the Department of Insurance. Subcommittees will continue hearing agency testimony next week, then move on to public testimony the week before the legislative Spring Break (April 15-19).New School Funding Formula Debut

The most-watched subcommittee hearings this week are likley to be those of the House Finance Primary Secondary Education, where members will hear the long-awaited details of the Fair School Funding Plan developed by a working group led by co-chairs Representatives Cupp and Patterson. Read more details about the plan, which was released at a news conference (watch online) earlier today.

The most-watched subcommittee hearings this week are likley to be those of the House Finance Primary Secondary Education, where members will hear the long-awaited details of the Fair School Funding Plan developed by a working group led by co-chairs Representatives Cupp and Patterson. Read more details about the plan, which was released at a news conference (watch online) earlier today.What’s in DeWine’s K-12 Budget?

$300 million a year more for wraparound services

This money would bring more mental health and other services to poor students, providing every district with at least $25,000, even if the district has only a handful of poor students, up to about $250 a student, which could make a real difference.

There would be cause for concern if this becomes a substitute for adequately funding schools. Our students deserve the investment the state simply hasn’t made for 30 years. And every kid deserves that commitment.

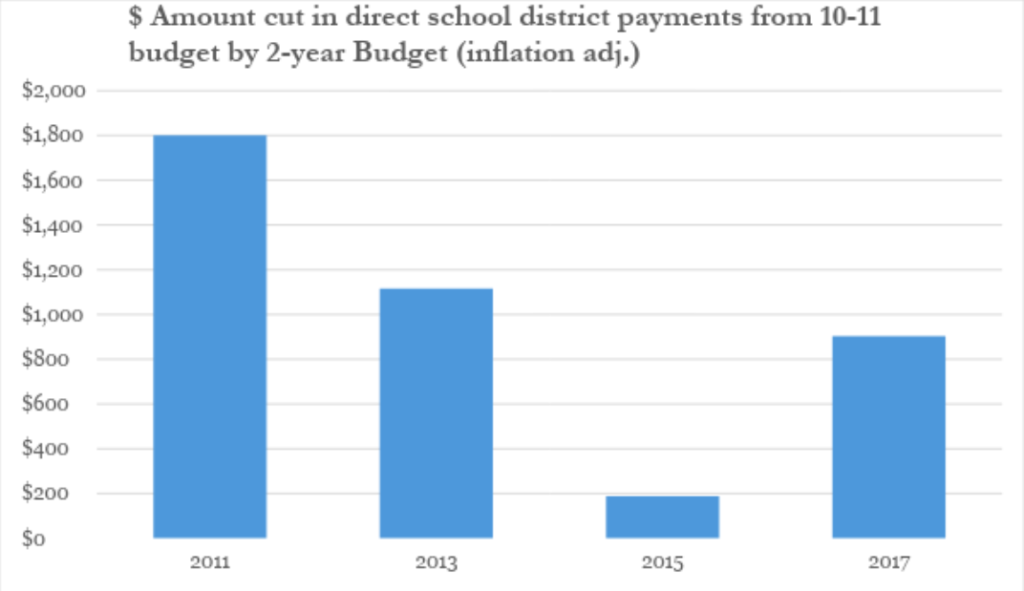

Even with $300 million more in the 2020-2021 school year, adjusted for inflation, districts would remain several hundred million dollars short of what they received a decade ago during the Great Recession.

$30 million for high performing charter schools

While Ohio absolutely should begin to differentiate between low and high-performing charter schools, creating a market based on quality rather than enrollment, DeWine is doing so by tapping into the state’s lottery fund, forcing cuts in lottery money headed to traditional public districts. At the end of this two-year budget, nearly $50 million will be headed to charters from the Lottery, which was supposed to go strictly to school districts. We need to be creating a charter school market that rewards success. But taking it out of funds voters created for school districts seems counterproductive.

There is already $16.6 million in the current state budget for high-performing charters to receive capital funding. Not even 25 percent of that amount has been spent because so few charters meet the criteria. Adding $30 million which is limited to the few high performing schools operated in Ohio in hope that more will materialize prevents that money from going to kids in our traditional public school districts.

Another big increase for the voucher program

DeWine continues the misguided increases to the EdChoice, income-based voucher in this budget. EdChoice has actually been shown to harm student achievement. Pouring $24 million more into this program that has hurt the kids who take the vouchers makes little sense. We also need to review amounts going into the other voucher programs when the final budget documents are released to see how much total revenue meant for school districts will be going instead to private, mostly religious schools.

$300 million a year more for wraparound services

This money would bring more mental health and other services to poor students, providing every district with at least $25,000, even if the district has only a handful of poor students, up to about $250 a student, which could make a real difference.

There would be cause for concern if this becomes a substitute for adequately funding schools. Our students deserve the investment the state simply hasn’t made for 30 years. And every kid deserves that commitment.

Even with $300 million more in the 2020-2021 school year, adjusted for inflation, districts would remain several hundred million dollars short of what they received a decade ago during the Great Recession.

$30 million for high performing charter schools

While Ohio absolutely should begin to differentiate between low and high-performing charter schools, creating a market based on quality rather than enrollment, DeWine is doing so by tapping into the state’s lottery fund, forcing cuts in lottery money headed to traditional public districts. At the end of this two-year budget, nearly $50 million will be headed to charters from the Lottery, which was supposed to go strictly to school districts. We need to be creating a charter school market that rewards success. But taking it out of funds voters created for school districts seems counterproductive.

There is already $16.6 million in the current state budget for high-performing charters to receive capital funding. Not even 25 percent of that amount has been spent because so few charters meet the criteria. Adding $30 million which is limited to the few high performing schools operated in Ohio in hope that more will materialize prevents that money from going to kids in our traditional public school districts.

Another big increase for the voucher program

DeWine continues the misguided increases to the EdChoice, income-based voucher in this budget. EdChoice has actually been shown to harm student achievement. Pouring $24 million more into this program that has hurt the kids who take the vouchers makes little sense. We also need to review amounts going into the other voucher programs when the final budget documents are released to see how much total revenue meant for school districts will be going instead to private, mostly religious schools. Preschool flat funded

This was actually shocking. Ohio’s struggles with early childhood education have been stunning, especially given how even conservative states like Oklahoma have created Universal Pre-K. And while there has been a lot of talk about beefing up our state’s early childhood program, this budget is not that.

Significantly more charter school oversight

DeWine increased the budget for ODE’s charter oversight office from $2.5 million to $7 million. That’s good, but still not enough to oversee an $889 million a year industry with a track record of fraud and underperformance.

Workforce Development

Much of DeWine’s workforce development agenda is funded within the K-12 budget, with new resources to help students achieve more industry-recognized credentials. Between 2014 and 2018, the percentage of Ohio students leaving high school with an industry-recognized credential grew from about 4 to just over 6 percent. While that’s a significant increase, it’s still far short of what our students should be achieving. We need more details to understand whether the new money in this budget would be paired with programs to motivate more students to seek these credentials during high school.

Conclusion

Overall, this falls short of the “investment budget” that DeWine promised. There are some small benefits and a few districts will see significant increases to address the real challenges of their most needy students.

But it’s neither enough money to overcome the needs of poor students in every district nor is it enough to overcome the last decade of Kasich budget cuts. All while charters more than double their money from lottery funds, vouchers continue to increase, and early childhood education is all but ignored.

Preschool flat funded

This was actually shocking. Ohio’s struggles with early childhood education have been stunning, especially given how even conservative states like Oklahoma have created Universal Pre-K. And while there has been a lot of talk about beefing up our state’s early childhood program, this budget is not that.

Significantly more charter school oversight

DeWine increased the budget for ODE’s charter oversight office from $2.5 million to $7 million. That’s good, but still not enough to oversee an $889 million a year industry with a track record of fraud and underperformance.

Workforce Development

Much of DeWine’s workforce development agenda is funded within the K-12 budget, with new resources to help students achieve more industry-recognized credentials. Between 2014 and 2018, the percentage of Ohio students leaving high school with an industry-recognized credential grew from about 4 to just over 6 percent. While that’s a significant increase, it’s still far short of what our students should be achieving. We need more details to understand whether the new money in this budget would be paired with programs to motivate more students to seek these credentials during high school.

Conclusion

Overall, this falls short of the “investment budget” that DeWine promised. There are some small benefits and a few districts will see significant increases to address the real challenges of their most needy students.

But it’s neither enough money to overcome the needs of poor students in every district nor is it enough to overcome the last decade of Kasich budget cuts. All while charters more than double their money from lottery funds, vouchers continue to increase, and early childhood education is all but ignored.ECOT Founder Sides With Mike DeWine In Court Filings

ECOT’s Long History of Problems

No Type of District or Community Immune to ECOT

Looking at just the districts’ poverty classification, ECOT received about 2/3 of its money from poor or very poor Ohio school districts. No surprise there. However, the next largest category of funding came from low poverty districts. More money came from Ohio’s wealthiest districts than school districts with average poverty.

What does all this mean? It means that ECOT’s largest impact was on Ohio’s poorest districts and students — areas and populations that have traditionally suffered outsized portions of public scandals like ECOT. However, the scale of ECOT’s scam was so large that even Ohio’s wealthiest school districts were not immune from this school’s politically connected tentacles.

Looking at just the districts’ poverty classification, ECOT received about 2/3 of its money from poor or very poor Ohio school districts. No surprise there. However, the next largest category of funding came from low poverty districts. More money came from Ohio’s wealthiest districts than school districts with average poverty.

What does all this mean? It means that ECOT’s largest impact was on Ohio’s poorest districts and students — areas and populations that have traditionally suffered outsized portions of public scandals like ECOT. However, the scale of ECOT’s scam was so large that even Ohio’s wealthiest school districts were not immune from this school’s politically connected tentacles.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 24

- Next Page »