What you need to know about Ohio Politics and Policy

Terra Goodnight · November 10, 2017

House Tax Plan fails to deliver on affordable childcare promise

Since taking office, Donald and Ivanka Trump have often promised that tax reform would provide help to families struggling with the high cost of childcare. The GOP tax plan, released last week, falls far short and actually leaves many families with children worse off.

Note: This post refers to legislation currently pending in the US House of Representatives. A separate bill has been introduced in the Senate and varies slightly from the House version, notably by allowing families earning up to $1 million to claim the Child Tax Credit.

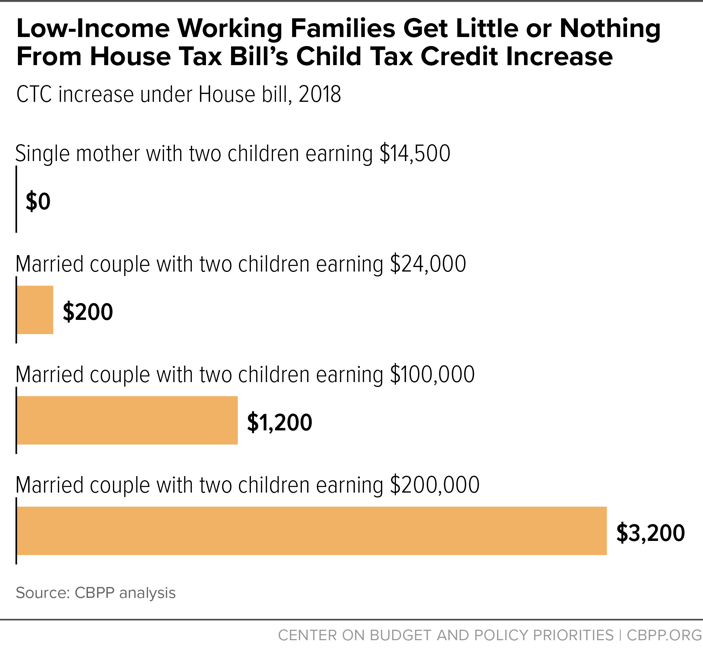

The GOP tax plan, currently pending in the US House, would increase the child tax credit (CTC) for working parents from $1000 to $1600 per child. (Unlike deductions, which reduce the amount of income on which you are taxed, tax credits directly reduce the amount of tax you must pay). The existing credit is only partially “refundable”, meaning that families due a tax refund, or who owe less the amount of the credit, only get a fraction of its face value, not to exceed 15 percent of their income over $3000. As a result, families living in poverty are already less likely to benefit than those in the middle class.

The additional $600 in the GOP plan is not refundable. Families with no net tax liability (e.g. a single mother working at minimum wage) will see absolutely no additional benefit. At the same time, the plan allows married couples earning as much as $230,000 to receive the full value of the credit, a big increase from today’s $110,000 income limit.

Note: This post refers to legislation currently pending in the US House of Representatives. A separate bill has been introduced in the Senate and varies slightly from the House version, notably by allowing families earning up to $1 million to claim the Child Tax Credit.

The GOP tax plan, currently pending in the US House, would increase the child tax credit (CTC) for working parents from $1000 to $1600 per child. (Unlike deductions, which reduce the amount of income on which you are taxed, tax credits directly reduce the amount of tax you must pay). The existing credit is only partially “refundable”, meaning that families due a tax refund, or who owe less the amount of the credit, only get a fraction of its face value, not to exceed 15 percent of their income over $3000. As a result, families living in poverty are already less likely to benefit than those in the middle class.

The additional $600 in the GOP plan is not refundable. Families with no net tax liability (e.g. a single mother working at minimum wage) will see absolutely no additional benefit. At the same time, the plan allows married couples earning as much as $230,000 to receive the full value of the credit, a big increase from today’s $110,000 income limit.

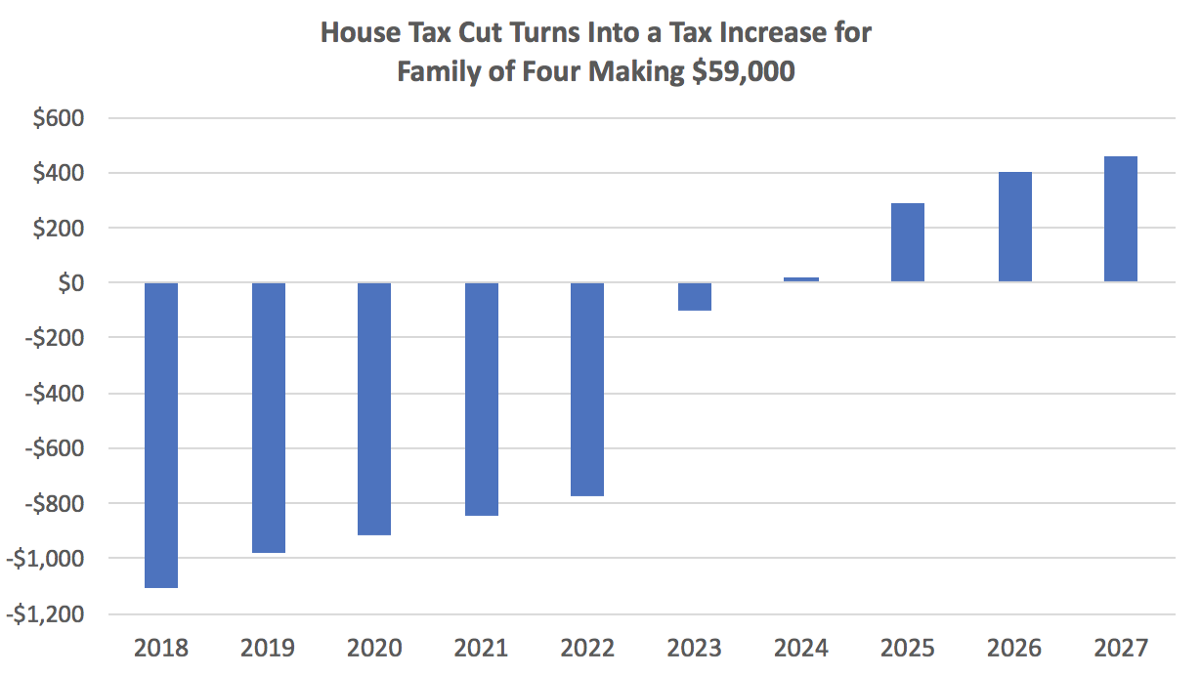

Bottom Line: over time, the GOP proposal to raise the CTC could still mean a tax increase for low-income families, little to no benefit for families in the middle, and a sizable new tax cut for families earning $110,000 to $230,000.

Tagged in these Policy Areas: