What you need to know about Ohio Politics and Policy

Terra Goodnight · February 15, 2017

Budget Continues Trend Toward Regressive Tax System, Asks Poorest to Pay More

Last month, Ohio Gov. John Kasich unveiled his last two-year budget proposal, featuring another large cut in the state income tax — $3.1 billion — paid for with new and increased taxes on everyday purchases like cable TV subscriptions, beer, wine, and increased taxation of oil and gas extraction.

This is not the first time Kasich has proposed cutting the state income tax — the state’s most progressive tax. The tax is designed so those at the top income level pay the highest rate. The state’s estate tax on inherited wealth was eliminated completely in the Governor’s first budget.

Over the past 12 years, Ohio has already reduced tax collections by over $3 billion thanks to repeated cuts to the income tax. Taxpayers in the top 1% of income-earners are keeping an additional $17,500 in their bank accounts every year as a result of Kasich tax policy, and his latest proposal would bring that annual benefit to over $20,000. While $20,000 is still not enough to create one good-paying job, even if you believed that’s how the money would be spent, it is foregone revenue to the state that could be investing it in priorities that really matter.

People with low-incomes spend much of their income on things that are taxed. As a result, they pay a much larger share of their income on taxes in states with regressive tax systems that rely heavily on sales taxes to fund state spending. According to the Institute on Taxation & Economic Policy, the poorest 20% of Ohioans pay nearly 12 percent of their income on state and local taxes, compared to just 5.5% paid by the top 1%.

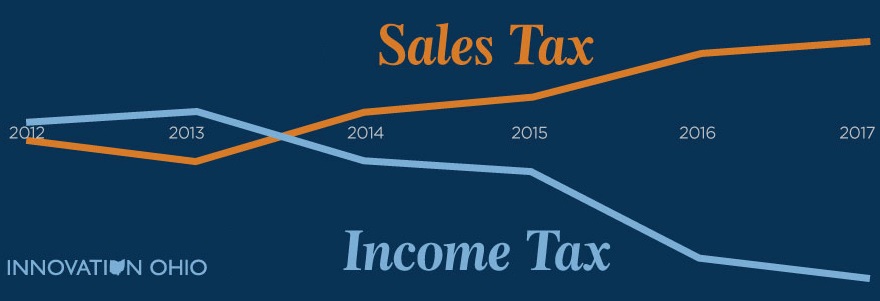

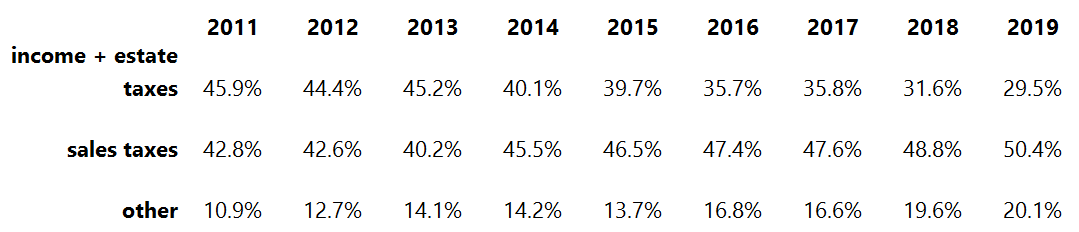

We crunched the numbers, and here’s how dramatic the shift has been over the span of the four Kasich budgets:

Combined, the state’s income and estate taxes have declined from about 46% of state general revenue to just under 30%. At the same time, sales taxes have increased from 43% to over 50%, now picking up the largest share of the cost of state government.

Combined, the state’s income and estate taxes have declined from about 46% of state general revenue to just under 30%. At the same time, sales taxes have increased from 43% to over 50%, now picking up the largest share of the cost of state government.

Tagged in these Policy Areas: Ohio State Budget