What you need to know about Ohio Politics and Policy

Terra Goodnight · March 21, 2013

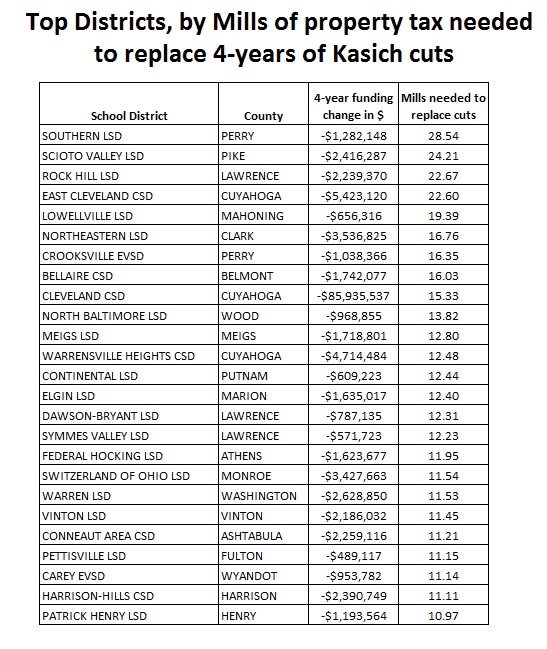

Top school districts, ranked by property tax needed to replace Kasich cuts

Governor Kasich’s first budget reduced funding for primary and secondary education by $1.8 billion. His new two-year budget provides additional resources — most of it temporary — compared to the last, but the combined four year-impact of Kasich budgets equates to net funding reductions for most Ohio school districts. Yesterday, we posted a spreadsheet containing the net, 4-year impact of Kasich budgets on every district in Ohio. Some districts are more equipped to compensate for state cuts than others. Lakota Schools in Butler County can raise nearly $2.8 million for every 1 mill they levy in property taxes. Lowellville Schools in Mahoning County, on the other hand, raise just under $34,000 on the same mill. As a result of their relative lack of property wealth, therefore, some districts have to ask taxpayers for much more than others to make up the cuts in state funding. Without additional service reductions, the average district needs to raise 2.76 mills of new property taxes to make up for the Kasich cuts. But for some, that number is much, much higher. Below are the top 25 districts, in terms of how many mills of property taxes are required to make up for 4 years of Kasich school funding cuts. You’ll see that Lowellville is on the list, needing fully 19 mills of new property taxes if they ever want to restore the cuts they will have experienced over four years if the Kasich budget proposal is adopted.

Tagged in these Policy Areas: K-12 Education | Ohio State Budget