What you need to know about Ohio Politics and Policy

Policy makers continue to make tax code in Ohio more regressive

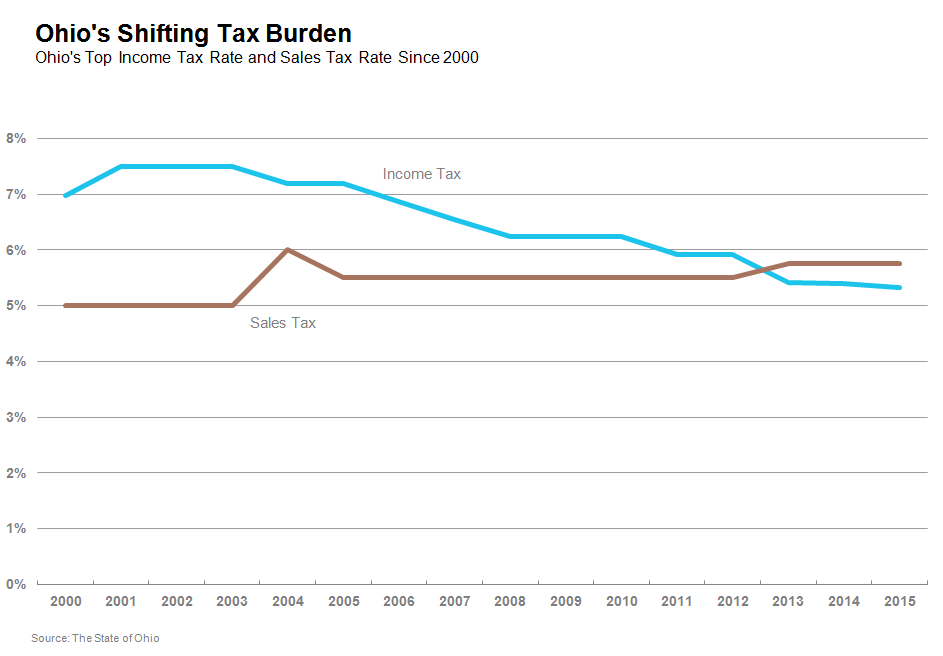

For over a decade, Republican lawmakers have been obsessed with continually lowering the state income tax rate. And with the signing of the state’s new two-year operating budget, Governor Kasich cemented his desire to continue this policy. The new state budget reduces income tax rates by 10 percent over the next three years. The graphic below charts the top tax rate in Ohio since 2000. As you can see, starting in 2015, the highest state income tax rate will be 5.333 percent compared to a high of 7.5 percent in 2001-2003.

Tagged in these Policy Areas: Ohio State Budget