What you need to know about Ohio Politics and Policy

Legislators Set to Benefit from Business Tax Cut

Today, a House-Senate conference committee is set to finalize the outlines of a broad package of tax reforms that will be incorporated into the state’s two-year budget.

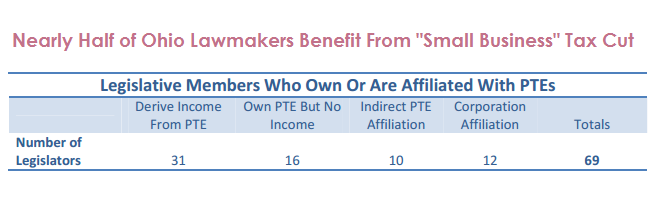

A new analysis by Innovation Ohio shows that nearly half the sitting members of the Ohio General Assembly could directly benefit from a new tax break aimed at business owners. Forty-seven legislators report an ownership stake in a pass-through entity, while another 10 have an indirect relationship through a spouse’s ownership or as an employee. Another 12 members list ownership in corporations that may elect to be taxed as individuals.

Both the House and Senate will cast final votes on the legislation later this week.

Read the IO Analysis.

View the lists of Senators and Representatives affiliated with apparent pass-through entities.

Today, a House-Senate conference committee is set to finalize the outlines of a broad package of tax reforms that will be incorporated into the state’s two-year budget.

A new analysis by Innovation Ohio shows that nearly half the sitting members of the Ohio General Assembly could directly benefit from a new tax break aimed at business owners. Forty-seven legislators report an ownership stake in a pass-through entity, while another 10 have an indirect relationship through a spouse’s ownership or as an employee. Another 12 members list ownership in corporations that may elect to be taxed as individuals.

Both the House and Senate will cast final votes on the legislation later this week.

Read the IO Analysis.

View the lists of Senators and Representatives affiliated with apparent pass-through entities.

Tagged in these Policy Areas: Ohio State Budget