What you need to know about Ohio Politics and Policy

A Winning Agenda for Ohio’s Working Familes

Table of Contents

AN UNCERTAIN FUTURE

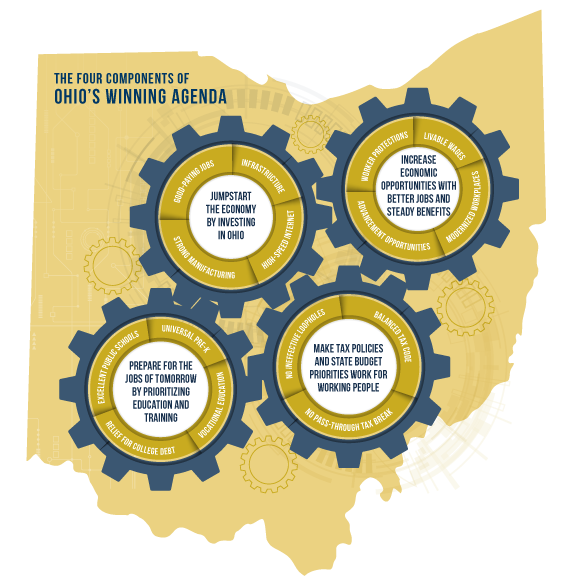

THE FOUR COMPONENTS OF OHIO’S WINNING AGENDA

CHAPTER 1: JUMPSTART THE ECONOMY BY INVESTING IN OHIO

CHAPTER 2: INCREASE ECONOMIC OPPORTUNITIES WITH BETTER JOBS AND STEADY BENEFITS

CHAPTER 3: PREPARE FOR THE JOBS OF TOMORROW BY PRIORITIZING EDUCATION AND TRAINING

CHAPTER 4: MAKE TAX POLICIES AND BUDGET PRIORITIES WORK FOR WORKING PEOPLE

CONCLUSION

AN UNCERTAIN FUTURE

Today, many working families feel a deep sense of anxiety. Technology is changing our jobs. And it’s becoming harder and harder to earn a decent wage and secure even the most basic benefits from employers.hese forces continue to shape our world and the Ohio governor cannot simply continue doing ting state leaders have been doing for the past decade. Instead, we need a new proactive agenda that builds economic security in an uncertain future.

A Winning Agenda for Ohio’s Working Families

Ohio became a great state by investing in people and infrastructure. People have historically come to our state from other countries and other regions, knowing this was a place to find good jobs and strong communities.

Past investments gave us high rates of high school graduation, one of the world’s best manufacturing workforces, and a tenacious sense of the value of work. We have a beautiful Great Lake, fertile agricultural resources, and rugged cities with proud histories.

Today, instead of understanding the challenges ahead and positioning Ohio for success, state leaders have focused on tax cuts for those who are already doing well. As a result, they’ve abandoned our values of investing in people and Ohio hasn’t seen the economic success that we were promised.

Ohio is losing over three billion dollars each year in tax revenues while our economy continues to create jobs at a slower rate than the national average. We need to invest in education and worker training, so that Ohio workers can be prepared for a changing economy. And we have to ensure workers’ rights so that Ohio’s people have the power to make tomorrow’s jobs good jobs.

That is why we need to be smart about the challenges ahead and proactive about how we position our economy and workforce for the future. We have to have an agenda that prepares our economy for success, invests in the next generation, and prioritizes the dignity and value of a hard-day’s work.

Chapter 1

Jumpstart the Economy by Investing in Ohio

CHALLENGE: Not only has Ohio’s job growth rate trailed the national average, but wages have remained stagnant for decades. Too many Ohioans are underemployed or working for low wages, and many of our smaller cities are suffering from a loss of anchor employers and failing infrastructure that makes attracting new employers a challenge.

OPPORTUNITY: We can grow Ohio’s economy by supporting middle-class opportunity and local entrepreneurs, not tax breaks and special deals for those already at the top. State policy can stimulate demand and economic growth by putting more money in the pockets of working people, creating world class infrastructure, building on our strength in manufacturing, and tying economic development spending to creation of good, living-wage jobs.

MAKE IT IN OHIO: KEEPING MANUFACTURING STRONG

Ohio’s historic prosperity is tightly welded to our manufacturing strength – policy can rebuild and retain that advantage.

Ohio has always been one of the best places on the planet to make things. Today we must embrace proven programs that strengthen manufacturing, create and retain manufacturing jobs, employ our world-class manufacturing workforce, and keep these jobs high-wage and union.

Policies to Build Manufacturing

Ohio should establish an Ohio Manufacturing Taskforce of business, labor, education and community groups to make recommendations about policies that will bolster the sector that played such an enormous role in creating Ohio. This will include creating an industrial commons, a set of shared resources that manufacturing firms and workers can tap in a changing economy. We already have a strong Manufacturing Extension Partnership system to build on. Ohio should add more state-supported teams to support reshoring—bringing jobs back home—in part by showing that doing so is often the most economical choice. Apprenticeships are also part of the solution, as are programs like Pennsylvania’s Strategic Early Warning Network that do more to avert layoffs, save jobs, and reduce costs to our state unemployment system. Find a deep analysis of the importance of manufacturing and the best tools to strengthen it in the recent report Manufacturing a High-Wage Ohio.

REBUILD OHIO’S INFRASTRUCTURE

We can put Ohioans to work and create an environment for investment by rebuilding the state’s decaying infrastructure.

Historically, we had some of the best infrastructure in the world. That’s what enabled Ohio companies to quickly get their products to markets all over the globe. Ohio must launch an ambitious program to repair its aging roads, bridges, dams, water and sewer systems and schools, and to weatherize commercial and residential buildings. In recent years, Ohio has shown weak commitment to growing wind and solar energy in Ohio. But our historic strength in glass-making and manufacturing component parts, used in both solar panels and wind turbines, means that we have enormous potential to invest in green infrastructure and create good jobs in the process. Renewed commitment to renewables could reinvigorate that industry here. Learn more in Efficient Power, Good Jobs, a 2016 paper from Policy Matters Ohio.

CONNECT THE ENTIRE STATE TO HIGH-SPEED INTERNET

High speed internet access has become a necessity for business, education and healthcare.

In Ohio, nearly 1 million residents are still unable to connect to broadband internet, primarily in rural areas. Recent legislation would direct $50 million from the Third Frontier program to subsidize local public and private sector last-mile infrastructure projects, particularly in sparsely populated areas where it will take years to recoup initial investments. State leaders should pass this legislation, which will help prevent further erosion of the tax base in our rural communities and small towns. This will help all Ohio businesses, students and healthcare providers to reach their full economic potential.

ADDRESS THE DRUG CRISIS WITH THE RESOURCES IT REQUIRES

Drug addiction is a crisis for our communities, one that we must address.

Addiction is a public health emergency in Ohio, which was second worst in the nation in drug-related deaths in 2016. Retaining the expanded Medicaid that has used almost entirely federal money to bring health coverage to more than 700,000 Ohioans is the first and most important way to make sure that all health problems are addressed, including addiction. But we need to do much more than just treat the symptoms of the crisis. Our families and communities are deeply threatened, and addiction is putting excessive demands on our safety net. We must invest much more in treatment, making it widely available to every Ohioan who struggles. We must create the infrastructure needed to enable recovery, like housing, training and community mental health services. Research can help as well, and Ohio recently announced a small annual investment from the Third Frontier research and development program to explore breakthrough technologies to end addiction. Expanded investment in medical research could address addiction, reduce costs of paying for treatment, and even potentially create jobs from commercialization of innovative treatments.

CREATE GOOD OHIO JOBS WHEN SPENDING OHIO TAX DOLLARS

State resources must be maximized, whether Ohio is acting as an employer, a contractor, an investor, or a purchaser of goods and services.

As the vehicle through which Ohioans collectively purchase billions of dollars of goods and services, state government is a major direct and indirect employer. Ohio’s personnel and spending policies can guarantee that all workers employed by the state or its contractors earn decent wages and benefits, including paid leave, health care and retirement benefits. The state should ensure that when it subsidizes business through contracts, grants, loans or tax incentives, those resources support jobs that allow workers to sustain themselves and their families with dignity.

Choose Ohio First

In Fiscal Year 2016, state agencies spent $2.1 billion on goods and services. Just three-fifths of that went to Ohio businesses. Our “Buy Ohio” rules give preference to Ohio vendors, but include exceptions if the price difference exceeds 5 percent and for out-of-state vendors from bordering states or with a significant Ohio workforce. We should review our purchasing preferences to ensure Ohio workers benefit from Ohio spending. At minimum, vendors should be required to describe where work will be performed before a no-bid contract is approved. Contracts should never go to firms that perform State contract work overseas.

Reverse Failed Privatization Practices

Shifting public services to the private sector may enrich business owners, but it often does not promote public interest. Too often promised savings never materialize, but working conditions and service quality diminish. Ohio has been particularly irresponsible in privatizing prisons and prison food. The decision to privatize must consider the full costs of contract enforcement and monitoring, and should also be attentive to job quality and labor standards. State policy must recognize that the resources we invest not only provide services, but also good jobs that sustain stable communities. In 2013, prison food service was outsourced to Aramark, which has since repeatedly violated health and safety standards. Many Aramark employees are paid so little that they or their families need assistance to afford food. Rejecting Aramark and accepting a proposal by the Ohio Civil Service Employees’ Association could have saved Ohio an estimated $6.9 million in 2019.

To make sure Ohio delivers quality services at a fair cost, we should avoid privatization. Ohio should prohibit outsourcing to companies that have broken the law or avoided taxes, Ohio law should allow cancellation of contracts if savings don’t materialize, and the state should be required to consider plans submitted by public workers.

Limit State Incentives to Projects that create Quality Jobs with real Community Benefits Ohio hands out tens of millions of dollars each year in tax breaks to businesses in exchange for a promise of new or retained jobs. These incentives drain vital revenues that could be spent on critical investments: especially education. In too many cases, these promises are not met. Many employers fail to create promised jobs, while still benefiting from state investments in permanent infrastructure like transportation links. Others, like Amazon, create a class of worker so underpaid they need public assistance to afford the basics.

Better targeting of the Job Creation Tax Credit would support higher job quality with our state incentives. Today, this program merely requires that employers receiving this tax break create 10 jobs within three years paying an average 150 percent of the federal minimum wage, or $10.88 per hour. We should demand more of firms seeking expensive tax breaks.

RESTORE LOCAL GOVERNMENT

Adequate funding for localities keeps our communities strong.

Local governments in Ohio lost $1.2 billion a year in state funding between 2010 and 2017, adjusted for inflation. This hurts counties, cities, villages, towns, and the special districts that provide critical services for children, seniors, mental health, fires and emergencies. Local governments are on the front lines of the drug epidemic. They assist the most with food and shelter. They are responsible for most of our roads, bridges and infrastructure like water and sewers. Ongoing cuts threaten the quality of life in Ohio communities. Funding to Ohio’s local governments must be fully restored. Learn more about how cuts have hurt local government in the Policy Matters’ brief called Post 2018-2019 Budget Bite: Local Governments from October 2017.

MAKE OHIO’S TAX CODE WORKING-FAMILY FRIENDLY

Putting more money in the pockets of people who need it most gives our economy an immediate boost.

Many special classes of Ohio taxpayers get refunds when their tax credits exceed their tax liability. The state already has refundable tax credits for motion picture producers, historic building rehabilitators, and venture capitalists. Refundable credits to the personal income tax claimed by only 22,106 tax filers added up to more than $158 million in 2015. But Ohio offers no refundable tax credits for working class people. This should change.

Sales Tax Rebate For Working Families

Ohio could quickly put more money in families’ pockets by creating a sales-tax credit, available to eligible taxpayers when they file annual returns. The move would offset a decade during which the state shifted from income taxes to sales taxes. This shift hurts working people because income taxes raise more from those most able to pay, while poor and middle-income families spend a higher share of their earnings. The rebate would stimulate consumer spending and the local economy, while partly making up for these shifts.

Seven states already offer such sales tax credits. We estimate that a sales tax rebate would have returned on average $106 to eligible low-income families in 2016. This credit could be targeted. Like the Earned Income Tax Credit, it would offer a larger credit to larger families and phase out as incomes increase. The modest credit ranges from $10 for a single person with income of at least $21,001 to $450 for a family of six with income below $5,000. It would benefit more than 690,000 Ohioans.

Expand the Earned Income Tax Credit

Low- and moderate-income families pay a higher share of their income in state and local taxes than higher-income taxpayers do. To partly make up for that, and to assist families that work but earn little, both the federal and Ohio tax code include an Earned Income Tax Credit. The credit helps working people take care of their families, but in Ohio is limited to people in a very narrow income band due to caps and non-refundability. Ohio should remove the cap and make the credit refundable. Learn more about how a stronger Earned Income Tax Credit could help Ohio in the Policy Matters’ January 2017 brief Ohio EITC too weak to work.

Chapter 2

Increase economic opportunities with better jobs and steady benefits

CHALLENGE: If you work hard and play by the rules, you should be able to provide for your family, see a doctor when you need to, and retire with dignity. That’s not the case in Ohio. Many employers just no longer provide a livable wage, health coverage, and retirement benefits. Seven of Ohio’s 10 most common occupations have an annual median wage less than 130 percent of the poverty level for a family of three.12 This means a typical worker in that field could work full-time, year-round and still need food assistance to feed a family. Job quality has declined, even since 2000. These mostly low-wage, non-union jobs are more likely to be held by women, people of color and immigrants who are not guaranteed benefits or basic protections in the workplace. But plenty of white workers and men are also left out.

OPPORTUNITY: To have an inclusive economy in which all Ohioans participate and enjoy economic security, we must commit that when people work hard, they can expect to live and retire without falling into poverty. We can achieve this through policies that lift wages and provide support like healthcare, childcare and transit for workers. We can and should end practices that exploit workers and low-income Ohioans.

RESTORE BASIC WORKER PROTECTIONS

The right to collectively bargain, the purchasing power of the minimum wage, and overtime protections are less strong than they were two generations ago. To get the state and the nation back on track we need to restore these basic protections.

Protect The Right of Workers to Bargain Collectively

Unseen forces of globalization and automation are often blamed for wage stagnation, but the intentional dismantling of union power is just as central to how our economy was allowed to grow so wildly out of balance.

Without the basic right to speak together for the good of working families and our state economy, the rules of the game will continue to be rigged in favor of the rich and powerful. Unions are how working people speak up for fair wages, benefits and working conditions. Where unions are strong, working people, even those not in the union, enjoy higher wages.

Unionized workers in Ohio make $4 an hour more than their non-union counterparts, nearly a 25 percent difference, more than $8,000 more a year for full-time work.13 Unionized workers are more likely to get health insurance, a pension and paid sick days, and less likely to face unfair treatment at work. Unions offer workers a way to balance their interests against the demands of the employer. Members are represented in contract negotiations, and have back-up to enforce their rights at work.

Unions are especially important for women and people of color. Black, white, and female workers all earn more when they are in a union, and the gap between races and sexes shrinks when workers can negotiate their wages together. In Ohio, between 2014 and 2016, women in unions earned 19.2 percent more than their nonunionized counterparts, white workers earned 7.4 percent more and black workers earned 22.6 percent more. The wage gap between men and women shrunk from 29.1 to 7.6 percent when workers were able to bargain collectively. The racial wage gap shrank from 35.8 to 19.0 percent.

Not only are policymakers trying to undermine unions, existing policy already forbids many workers from seeing the benefits of collective bargaining. Home health aides, childcare providers, adjunct faculty and other should be permitted to organize so they can win better wages and working conditions. We should help build unions in emerging parts of our economy like retail, call centers, warehouses, ride-hailing companies, and other employers in the low-wage economy.

Opposing so-called right-to-work legislation and protecting the right for Ohio workers to bargain collectively is essential to building an economy that works for everyone. Instead of fighting unions, Ohio policymakers should be doing everything possible to help more workers join a union and win the protections and collective voice that unions can bring.

Raise The Minimum Wage

Ohio’s economy has grown but wages have not, in part because our minimum wage has not kept up with inflation.

Ohio’s economy has grown more than 65 percent in a generation. The workers who created this wealth have not shared in the growth.15 The poorest 30 percent of workers have lost about 40 cents an hour in wages since 1979. This means a family of three with a breadwinner working full-time at minimum wage would earn $3,500 below the poverty line. Ohio’s minimum wage currently sits at $8.30 an hour, barely enough to support an individual with full-time, year-round work, let alone a family. If the minimum wage in Ohio had grown in tandem with the state economy since 1968, it would be worth more than $20.39 today. Working people should make enough to feed their families and pay their bills. Instead, we’ve seen real wages decline over a generation, even as workers have become more productive and educated than ever before. Raising Ohio’s minimum wage to $15 by 2025 will bring a meaningful increase in pay for nearly 1.8 million Ohioans. This would help not only minimum wage workers, but other workers now earning above the minimum wage. Read how a higher minimum wage could help Ohio’s working families in the July 2017 brief Minimum wage hike would boost Ohio workers from Policy Matters.

Restore the 40-hour work week

No one should be forced to work long hours without compensation.

Ohio must restore the 40-hour work week by updating our overtime laws. An increase in the salaried worker overtime threshold to $47,476 would boost the pay of 351,000 Ohio workers.17 This would help workers earning above the minimum wage and some workers who are salaried, but regularly work overtime.

Currently, many categories of salaried workers are automatically eligible for overtime pay only if they earn less than $23,660. This means many salaried managers at restaurants and retail can work well over 40 hours a week and be paid only $23,660—an amount that would keep a family of four in poverty. The overtime threshold is set so low just 7.8 percent of salaried working Ohioans are covered.

In 2016, the Department of Labor revised this rule but the Trump administration abandoned it under court challenge last October. Since then, Ohio workers have lost more than $10 million in wages.18 Every week that passes without action adds another $866,234 to that total.

Ohio policymakers must act. Pennsylvania’s Governor is introducing legislation to lift that state’s threshold. New York and California have raised the state threshold and passed future increases to catch up with inflation. Ohio should do the same. Learn more about overtime and other ways to help working families in the February 2018 Policy Matters’ report A new way forward: 10 ways to support Ohio’s working people.

Enforce Wage and Hour Laws

The State is charged with ensuring workers are paid for the hours they work and receive the benefits to which they are entitled. We must live up to that responsibility.

When employers don’t pay workers the full compensation they are legally entitled to, they are stealing worker wages or engaging in wage theft. Ohio has the second highest share of workers who are victims of minimum wage violations.20 More than 5 percent of Ohio workers, and nearly 23 percent of low-wage workers are not receiving full compensation under minimum wage law. The lost wages amount to just over 22 percent of impacted workers’ earnings.21 This number represents only the effect of minimum wage violations, just one form of wage theft.

The state has some measures in place to protect workers, from confidential complaints to imposition of triple damages on violators.22 But the state under-invests in enforcement. Budget cuts forced consolidation and personnel erosion in Ohio’s wage and labor investigative departments. The number of investigators dwindled from an already-measly 15 in 2008 to just six in 2018.23 That is just one for every 795,883 private-sector workers. State support for wage and hour enforcement is just $2.3 million over 2018-2019. Real investment and targeted enforcement in low-wage sectors is needed. The February 2018 Policy Matters’ report A new way forward: 10 ways to support Ohio’s working people24 also provides details on wage and hour enforcement.

Health Care

Health care is a right that should be ensured for all Ohioans.

The federal Affordable Care Act helped nearly a million Ohioans get health insurance coverage, dramatically improving a problem that had been growing worse for decades. Medicaid expansion in particular meant that more than 700,000 Ohioans who earn too little to pay for their own coverage were able to be insured using almost entirely federal dollars. The federal government covers 90% of the costs of Medicaid expansion. Ohio lawmakers should retain Medicaid expansion without ineffective fees and requirements.

Medicaid is essential to Ohio families. The program was the single largest payer of healthcare costs in Ohio in 2017, insuring a quarter of our residents, including about 1.2 million children. We should address remaining challenges in health coverage in the subsidized marketplace, to make sure all Ohioans have access to affordable, accessible health care, everywhere in the state.

Paid Leave

People who work hard and play by the rules shouldn’t be afraid of losing their jobs if they get sick or need to take care of a loved one.

Today, just 13 percent of private sector workers have any form of paid family leave, and only 4 percent of low-wage workers do. This means the majority of Ohio workers are forced to choose between their job and their family obligations. They can’t get paid time off even if they have to recuperate from childbirth or help a parent going through chemotherapy. Paid family leave has been shown to foster better workforce attachment and retention, and a number of health benefits for children and new moms. Five other states and the District of Columbia have a statewide family and medical leave insurance program allowing workers to take up to 12 weeks off with partial paycheck replacement to care for a new child or address a serious medical condition. Ohio should do the same. The plan could be funded through small payroll deductions, administered by the state.

EQUAL PAY FOR EQUAL WORK

The persistent gender wage gap prevents Ohio women from reaching their full economic potential and hurts the economic security of women and their families. On average, women working full-time in Ohio earn only 75 cents for every dollar their male colleagues take home. This means an average annual wage gap of $12,686. While the wage gap has narrowed since 1979, nearly half the change was the result of falling men’s wages. And the gender wage gap is even larger for women of color: Black women are paid, on average, 64 cents and Latinas paid, on average, just 61 cents for every dollar paid to white, non-Hispanic men. Failing to provide equal pay for equal work not only hurts women’s paychecks, but causes longer-term harm to women’s wealth attainment, investment, and retirement savings.

Ohio lawmakers should enact legislation to promote pay equity, such as strengthening enforcement of pay discrimination, closing employer loopholes in laws, eliminating the practice of asking for salary history, and preventing retaliation against an employee who discusses salaries or wages. These specific pay equity policies coupled with additional workplace policies like paid leave, ending the tipped sub-minimum wage, and raising the minimum wage all contribute to closing the gender wage gap and allowing women to provide for their families with dignity.

MODERNIZE WORKPLACE RULES

Work has changed but our laws have failed to keep up – and even gone backward.

To ensure economic security we should expand protections to workers in contingent jobs and nontraditional employment while bringing equity to the workplace.

Support Independent Contractors and those in Non-Traditional Employment

When workers are improperly classified as contractors, they can lose benefits to which they are legally entitled.

Exploitation of independent contractors is a significant issue in the so-called “gig economy.” By contracting with workers as independent contractors instead of employees, businesses bypass requirements of the Federal Fair Labor Standards Act. These workers are not afforded the typical employee benefits of health insurance, workers’ compensation, traditional tax withholding, and unemployment benefits. Workers can be better protected by strengthening how the state allows employers to classify employees. Currently, Ohio has a decentralized approach. Whether a worker is classified as an independent contractor for workers’ compensation purposes is dictated by a 20 part test. For unemployment compensation, a different test is used. For wage and hour requirements, the state follows the federal Fair Labor Standards Act, and for income tax status Ohio uses the IRS standard. Legislation to clarify and simplify Ohio’s misclassification rules by instituting a 7-part test has consistently failed to advance.

Ohio has lost millions of dollars in unemployment compensation revenue, workers’ compensation premiums, and state income tax revenue, not to mention the lost supports to families because the state failed to tighten definitions and enforce the law. Simplifying the test is the first place to start making our rules match the modern workplace.

Guarantee Fair Schedules for Shift Workers

Many Ohioans do not know when or how many hours they are going to work on a week-to-week basis. Unstable scheduling makes it impossible for workers to plan their daily lives: working parents cannot make arrangements for childcare, students can’t easily schedule classes, and too many find themselves living their lives on permanent hold, never knowing when they will be required to report to work or be sent home without the valuable hours they need to make ends meet.

Fair scheduling laws offer basic guarantees that improve the quality of life for Ohio workers. Oregon was the first state to adopt fair scheduling laws, but the city of San Francisco provides the most comprehensive protections. Fair scheduling means workers get at least two weeks advance notice of schedule; predictability pay if the schedule is changed without 7 days notice; a good-faith estimate of the number of shifts or hours per month; access to hours, where employers must offer part-time employees the chance to cover extra hours before hiring new employees; and a rule that if a company is sold, the new employer must retain tenured employees for a 90-day transition period. Ohioans deserve stability in their work lives and the ability to plan for the future in weeks, not hours.

Protect Ohioans from Discrimination

To ensure a fair playing field and continue to attract the best and brightest talent, Ohio must aggressively enforce its anti-discrimination laws and expand them to include sexual orientation and gender identity. We should complement existing laws with tools to better ensure that workers are not paid unequally merely on the basis of their gender, orientation, race or age. All individuals experiencing discrimination should be allowed to bring a case at the Ohio Civil Rights Commission.

MAKE IT WORK TO GO TO WORK

Work supports bring people into the workforce and keep them working when times are tough. Ohio needs investments that support economic mobility and policies that reduce barriers to work and advancement.

Inequality is not the natural order of our economy. It is the product of our policy choices. Ohio can have an economy built from the middle out, but we have to support workers as they earn their way out of poverty. Policy can help or hinder efforts to join the middle class. Ohio has disinvested or ignored the importance of these supports. It is time that changes.

Affordable Quality Childcare

All parents want their children to have the opportunity to get ahead. They also need to earn a living to support their family. High-quality childcare and early education helps Ohio families do both, but it is harder to qualify for childcare assistance in Ohio than in 44 other states.25 Fewer working families are eligible to get help with childcare today than in 2010.

The state could improve our ranking and get affordable childcare to more working families by returning initial eligibility for the program to 200 percent of poverty ( $32,920 for a family of two). Eligibility standards should also be consistent across public child care and preschool programs so families have more options for care and enrichment. Ohio’s public childcare system should pay adequate wages so that workers doing this important job are not themselves stuck in poverty. The state can ensure this by increasing provider rates so more can enroll in the Step Up to Quality program. Learn more about childcare in 2018-19 Post Budget Bite: Public childcare and early education, a November 2017 brief from Policy Matters.

Affordable and Accessible Transportation

Without reliable transportation, it is impossible to work, attend school or see a doctor. Ohio spent less per person on public transit per capita than 44 other states and the District of Columbia in 2014,28 and spends far less than the documented demand. In 2015, the Ohio Department of Transportation released the Statewide Transit Needs study showing that to meet current demands, the state should be spending more than $120 million per year on transit29, compared with approximately $40 million today. This would still represent just one-tenth of the total cost of providing transit services in urban and rural areas. Compounding the fiscal challenges, the state recently eliminated a critical source of local funding for transit: sales tax on Medicaid managed care services. Without a replacement, local systems will lose an additional $38.6 million each year starting in 2019.30 Check out Policy Matters’ Post-Budget bite on Public Transit from October 2017.

Protect Working People from Falling into Debt Traps

Our low-wage economy and weak safety net leaves many working people with few options when they need emergency cash. Cars break down, workers get sick, and without solid transit, childcare, or sick leave, many workers find themselves in need of fast cash. The payday lending industry has turned the state’s failure to invest in these workers into a profit-making machine. Borrowers in Ohio are paying, on average, an effective 591 percent APR or even more. The average cost to borrow $300 in Ohio is $680 over five months, the highest in the nation. The result is that payday loan fees extract more than $500 million from Ohio borrowers and from Ohio’s local economies each year. High-cost loans trap borrowers, drain communities of assets, and keep families poor.

Ohioans do not support a second-class banking system for struggling people. In 2008, Ohio voters overwhelming rejected predatory payday lending and upheld the Short-Term Lender Law, passed with bipartisan support.32 Yet predatory lenders continue to make loans at similar or worse rates. By licensing themselves under the Ohio Mortgage Lending Law or the Ohio Small Loan Act, lenders avoid the regulations and consumers get few of the promised protections. Legislation has been introduced to rein in some of the worst abuses, but it does not fully restore the protections Ohio voters supported in 2008.

Policymakers have failed Ohio voters and consumers twice, first by putting families in the position where they need loans to get by and second by allowing lenders to skirt rules.34 It is time to close the loopholes without weakening the standards. Ohio consumers and communities deserve real protection.

Offer Treatment and Employment as Alternatives to Prison for People Battling Addictions

Addiction has become a public health emergency in Ohio, which was second worst in the nation in 2016 with 4,329 overdose deaths.35 The number of deaths is rising: by August, 2017, Ohio’s 12-month estimate was pegged at 5,234 drug deaths.36 A recent study found that up to half of the drop in workforce participation among working-age men in Ohio could be a result of addiction.37 In 2016 alone, over 631 million prescriptions were written in the state – enough to supply every Ohioan with over 54 doses of opioid painkillers.38 Treatment, local response capabilities and prevention must be funded and coordinated across state agencies and in partnership with the private sector and local government. To fund its efforts, in addition to adequate taxation, Ohio should aggressively pursue damages against pharmaceutical manufacturers, distributors and large pharmacy chains who looked the other way as excessive quantities of pills flooded our state. The state must also expand drug courts to every county, and provide more community-based alternatives to prison and a pathway back to employment.

End Onerous Regulatory Barriers to Employment and support Neighborhood Safety

An economy that works for everyone cannot exclude 1 in 6 Ohioans, but for those with criminal records, the path to employment features insurmountable obstacles.

Today, people with a criminal record routinely face significant barriers to employment, housing, and over 1,000 rights and privileges that can render them unable to contribute to the economy. These barriers, called ‘collateral sanctions,’ can block people from reintegrating into communities, getting a job, or entering a new career.

Ohio should examine our occupational licensing system, with an eye toward reducing collateral sanctions that are unrelated to success, safety, and job performance. Similar reviews should focus on barriers targeting immigrants. Occupational licensing reform should not erode safety and quality standards or drive down wages.

Ohio has a program to eliminate some employment barriers created by incarceration, called the Certificate of Qualification for Employment.41 The process has fees and is tough to navigate without assistance. Expanding support for CQEs while reviewing licensing requirements will help more Ohioans find careers.

Increase public safety while decreasing incarceration

We can make our communities safer by redirecting spending from over-incarceration to initiatives that are proven to improve public safety. Ohio’s prisons are overcrowded, putting officers, inmates and communities at risk. Prisons are at 132 percent of capacity.42 Ohio’s incarcerated population quadrupled between 1978 and 2014, to more than 52,500 people—450 of every 100,000 Ohioans.43 The climbing share of Ohioans in prison has had no measurable correlation to crime rates, which varied over the same time.

Over-incarceration hurts families, communities, and our state budget. Many Ohioans are locked out of the job market permanently for low-level offenses. Communities have been devastated by over-policing and aggressive sentencing. This destroys families, and removes from civic life and the labor market people who could contribute. The Ohio Organizing Collaborative has developed a four-part plan to increase safety and reduce over-incarceration and overcrowded prisons. This initiative stops the addiction-to-prison pipeline by reclassifying drug-possession felonies as misdemeanors, while maintaining tough protections against drug trafficking. This enables treatment without the lifelong burden of employment-blocking collateral sanctions. The plan also ends the probation-to-prison pipeline. Nearly 23 percent of people entering prisons each year are there for probation violations, not new infractions. Local sanctions can effectively hold probation violators accountable, without adding to prison overpopulation. The plan creates small time-reduction rewards for incarcerated people successfully participating in rehabilitation. Savings will be directed toward programs that have been shown to truly increase community safety.

Chapter 3

Prepare for the jobs of tomorrow by prioritizing education and training

CHALLENGE: Ohioans are more educated than ever before. The highly-competitive, global economy will demand an even better-educated workforce. But Ohio has consistently underfunded our public schools, shifted tax dollars from public schools to scandal-ridden, poor-performing, private for-profit charter schools, and underfunded higher education and need-based aid. As a result, Ohio’s education rankings have dropped significantly compared to other states.

OPPORTUNITY: If Ohio is to be a leader in tomorrow’s economy, education and worker training must be a priority today. With a comprehensive approach and the vision to invest, Ohio will better prepare the next generation. Creating an educated, highly-skilled workforce will also attract new businesses to the state and position our economy for success in an uncertain future.

EXPAND UNIVERSAL PRESCHOOL

Early learning facilitates later learning, and quality preschool closes gaps in achievement and school readiness.

Others states are putting in place universal public preschool, recognizing that early education is essential to school readiness. Ohio can bring universal pre-K closer to reality by doubling the number of available public preschool slots for less than $100 million each year. This could be easily paid for by any one of the several revenue changes we suggest in the final section of this report. To learn more about how to fix Ohio’s underfunded childcare and preschool system, see Policy Matters’ post-budget bite Public childcare and early education45, from November 2017.

GUARANTEE UNIVERSAL ALL-DAY KINDERGARTEN

Attending full-day kindergarten is proven to help kids do better in reading and math throughout their lives.

Many districts in the state are already offering all-day kindergarten, but Ohio can get this benefit to all children, regardless of where they live, by restoring a rule repealed in 2012 mandating all-day schedules and funding schools to expand their capacity to serve more students.

FULLY FUND OHIO’S K-12 PUBLIC SCHOOLS AND FOSTER A LOVE OF LEARNING

More students are graduating than ever before, but almost all jobs now require at least a high school diploma. Today’s students need advanced skills to succeed in the 21st century workforce. Ohio must fund a modern and equitable system of public education, regardless of school type or community wealth so our state is not left behind.

Nobody’s zip code should determine the quality of their education. To rebuild our schools the state must determine what resources kids need to excel in the 21st century, then firmly commit to funding it, regardless of school type, based on actual costs and educational setting. Today many schools receive less state support than they did in 2010 – reversing that will increase quality and equity. Public schools should not finance poor performing charters and private schools.

The 90 percent of Ohio children enrolled in traditional public schools should not be short-changed to increase funding for Ohio’s charter schools and private school vouchers.

If any public funding goes to charters, those that spend less than public schools should be provided less. Funding should come directly from the state, eliminating the current system of transfers from local public schools that in many cases results in a shortfall to be made up by local taxpayers. Operation of the state’s charter schools should be limited to nonprofit entities so tax dollars remain in classrooms, not padding corporate profit margins. Ohio’s charter oversight system should reward and grow high performers while quickly eliminating poor performers, creating cost savings that can be reinvested back into public education. Like charters, private school vouchers should be limited to schools that provide options that are at least as good as the public schools that students leave behind.

Testing should make sense and support learning.

We must provide personalized instruction by offering a complete curriculum delivered by professional teachers with extensive training. Testing should be preserved as a diagnostic tool, but high-stakes tests should be deemphasized as an accountability measure for schools, districts and teachers and should not occur every year. Federal policy now gives states flexibility on standardized testing. We should minimize standardized testing so teachers can focus more on learning and less on test taking. Ohio should find ways to measure love of learning, creativity and critical thinking to get a more well-rounded assessment of school, district and teacher success.

LEVERAGE OUR PUBLIC SCHOOLS AS HUBS FOR HEALTHY COMMUNITIES

When students, families and communities are physically and emotionally healthy, educational outcomes improve and workers are better prepared.

One of the most promising investments states and communities can make is in wraparound services for students, especially in high-poverty areas. These services include nurses, social workers, clinics and family resource centers. While each district and community will have different needs, if Ohio invested some of the recovered money from failing charter and voucher programs into growing the state’s wraparound services (similar to California’s Healthy Start program, which gives seed grants to districts and schools to expand wraparound services), children could see as much as a 25 percent increase in reading achievement and 50 percent increase in math achievement.

EXPAND AND IMPROVE CAREER TECH AND VOCATIONAL EDUCATION

Traditional college isn’t the right fit for all students. Investments in Career Tech and VocEd can give students other options, while preparing them for careers that are in demand.

Career technical education is a meaningful alternative to traditional college for many Ohio students. Strengthening secondary and postsecondary CTE programs will expand Ohio’s pool of skilled labor, making the state a more appealing place for businesses looking to expand or relocate while helping local businesses already looking to hire.

Ohio has been proactive in strengthening the state’s CTE programs but challenges persist. Without competitive salaries and incentives or better awareness of teaching opportunities, it is difficult to lure professionals away from their fields and into the classroom, and the challenge is greater in lower population, rural areas. The State must also take an active role in helping companies and schools partner to develop comprehensive education plans, and we should encourage some professionals to consider new careers in education.

We should also be pushing the boundaries of innovation with new policy initiatives. Arizona is preparing more students for the workforce by allowing any student under age 21 to complete a CTE program, even if that student has already graduated high school or completed another program.47 South Carolina grew its number of applicants to the federal apprenticeship program by nearly 700% by offering a small tax credit and doing more to connect students with employers. Arkansas voters elected to dedicate 60% of the tax revenue from legalized medical marijuana to CTE program development and a new Vocational and Technical Training grant fund.

MAKE DEBT-FREE COLLEGE A REALITY

Higher education is critical to building a 21st Century workforce. State investment in higher education is correlated with higher productivity and wages.

Because of weak state support, Ohio’s public universities and community colleges are in an affordability crisis.50 They are shifting costs to families in the form of higher-than-average tuition and underfunded need-based financial aid. Policies that make debt-free college possible help everyone succeed, regardless of the wealth of their parents.

Other states, like New York, Oregon, and Tennessee, are starting to promise an education at a two- or even four-year public college. Ohio should expand our own need-based funding grant, the Ohio College Opportunity Grant, to make debt-free college a reality for students who struggle most to afford education. We have to reform the OCOG funding formula to better target these students and allow those with most need to apply the grant to tuition and fees before other sources of aid. These changes will allow students to more effectively stack their financial aid and reduce the need for loans to cover unmet need. Even moderate reform of OCOG – making the grant available to students whether they attend community college or a four-year school – would reduce debt. Earlier research shows that loans to community college students increased by about 27 percent in the first years after losing OCOG eligibility.

RELIEVE THE CRUSHING STUDENT DEBT BURDEN

Ohio leads the nation in student loan debt burden, preventing our young people from getting ahead.

In Ohio, more than 1 million people hold $57.6 billion in outstanding student debt, a staggering figure that does not even include private loans.52 Perhaps surprisingly, borrowers with relatively small debts have some of the highest rates of default. Those borrowers often did not finish their degree and have lower earnings.

Ohio should protect students from predatory student loan collection and repayment practices by regulating student loan servicers and establishing a state student loan ombudsperson to advocate for borrowers by investigating complaints against loan servicers and to educate students about best options from origination to payoff. Too many believe the loan servicer is acting in the debtor’s best interest but investigations have revealed that many servicers are not offering the most appropriate repayment plans. Bad fees and misapplied payments make the loans much more difficult to pay off. State regulation is overdue. Learn more in Ohioans need more protection from student debt trap, a July 2017 report from Policy Matters.

PROTECT STUDENTS FROM PREDATORY INSTITUTIONS

Risky, for-profit career colleges prey on students, fail to deliver on promises of jobs, and create a student debt crisis for Ohio.

Risky for-profit career colleges typically have higher rates of default than public or nonprofit institutions. They compare poorly on student earnings outcomes and typically cost more than available public options. Grant awards and other state support to these predatory schools signal to prospective students that the schools are solid investments, when they actually increase debt and fail to deliver degrees much more of the time. Ending state financial aid to these schools would save more than $7 million per year. Check out Risky business: For-profit education in Ohio, a May report from Policy Matters, to learn more about how to rein in problematic for-profit colleges.

Chapter 4

Make tax policies and budget priorities work for working people

CHALLENGE: After over a decade of tax cuts, Ohio continues to create jobs at a slower rate than the national average. Bad tax policies have cut the available resources to invest in basic building blocks of a strong economy – schools, technology, infrastructure, and our workforce.

OPPORTUNITY: We can change this trajectory by rebalancing our tax code and reversing bad tax policies that don’t create jobs. With several common sense changes in tax policy, Ohio will have the necessary resources to invest in our economy, and prepare Ohio’s workforce for the future.

MAKE OHIO’S BUDGET WORK FOR WORKING PEOPLE, NOT JUST SPECIAL INTERESTS AND THE 1 PERCENT.

Tax cuts over the last decade have left Ohio ill-prepared to deal with the powerful forces that are changing our economy and threatening the future of work. Cutting taxes for the wealthy and large corporations has dominated Ohio policy for years with disastrous results. These cuts have failed to boost the state’s job growth rate, wages have been stagnant for over a generation and a growing percentage of working age adults have left the workforce. It has become more difficult for working Ohioans to get by. Ohio is overdue for a new agenda; one that supports everyone’s success, not just that of those already at the top.

At the same time that stagnant incomes have put pressure on state tax collections, lawmakers have cut the income tax by over a third, primarily through tax cuts for the wealthiest Ohioans. These tax changes shrink the tax base by billions of dollars annually.

By starving the state of resources, leaders in Columbus have allowed the safety net to fray and failed to make critical investments in education and training for opportunities in the new economy. State cuts to local governments have stifled communities’ ability to respond to challenges posed by poverty and addiction, or to make critical investments in neighborhoods, schools and downtowns. As a result, poverty remains alarmingly high, higher education is wildly unaffordable, and overdoses are overwhelming. Income inequality has worsened as the tax system becomes more regressive, rewarding those at the top while still failing to generate higher wages or better jobs for everyone else. In 2016 the state’s wealthiest 1 percent earned more than 19 times the average of the bottom 99 percent of earners.

A progressive platform for Ohio requires a reckoning with these failed policies of the past. We must clean up and modernize the tax code so the state can make investments that help Ohioans thrive. Cutting ineffective special interest tax breaks and asking the wealthiest to pay their fair share would allow us to once again support needed investments in Ohio’s classrooms, workplaces and communities.

Below we identify some critical policies that must be changed to rebalance our tax code and create budget stability to adequately prepare our state for the future:

Eliminate the LLC Loophole (the Passthrough Tax Break)

Ohio should end its $1 billion annual tax giveaway to individuals who hold ownership in limited liability companies (LLCs) and others known as passthrough entities. They can collect up to $250,000 in income from these companies tax-free, and pay a special low rate on amounts above that. But this hasn’t led to more jobs or new businesses. Learn more about the Passthrough or LLC Loophole in the May 2017 report called The $1 billion tax break burning a hole in Ohio’s budget, from Policy Matters.

Revenue impact: More than $1 billion.

Restore Balance To The Tax Code

We must end tax policies that worsen income inequality and give tax breaks to the most fortunate among us. We should restore the pre-2005 tax rate of 7.5% on income in excess of $218,250 and introduce a new 8.5% bracket for those earning a half million or more. For more, see Ohio needs a strong income tax58 from Policy Matters, February 2017.

Revenue Impact: Nearly $1.7 billion, combined with the repeal of the LLC loophole.

Close Ineffective Tax Loopholes

We should heed bipartisan calls to close loopholes in the tax code that create special advantages for narrow interests and industries. For instance, we could cap the discount that retailers receive for collecting the sales tax, reduce the business-tax exemption for suppliers to big distribution centers, and eliminate the sales-tax cap on purchases of aircraft time-shares. We should support certain tax exemptions and credits meant to help struggling Ohio families to people with modest incomes. All you need to know about tax loopholes can be found in the September 2017 Policy Matters’ report Ohio’s tax breaks are ready for review.

Revenue Impact: $150 million.

Impose A Fair Tax On Resource Extraction

Ohio now ranks 7th among states in natural gas production.62 The industry has grown rapidly, imposing costs to maintain roads, infrastructure, and even health care in communities that suddenly have more traffic, pollution, and activity. Other oil and gas states, like Texas, have severance tax rates of 7 percent or higher. Before these resources are depleted, Ohio lawmakers should capture a fair share of the natural gas boom for all Ohioans by establishing a severance tax rate of 7.5 percent. Governor Kasich proposed an increased severance tax that would have raised $310 million in 2019; lawmakers did not even consider it. They are cheating Ohio’s people out of our fair share of the natural resources of our land. See how a better severance tax could enrich Ohio in the April 2017 Budget Bite: Severance Tax, from Policy Matters.

CONCLUSION

In the twentieth century, Ohio was a place where people came for good jobs and strong communities. Three decades of eroding worker protections and nearly two decades of tax cuts have put the American dream out of reach for many Ohioans. Our people are more educated, more productive, and more diverse than ever before. Ohio remains a state with some of the best manufacturing skills and infrastructure in the country, with strong libraries and universities, with a beautiful Great Lake and a varied, vibrant economy. Yet, too many parents worry that their children will not do as well as they did. Some politicians and donors stoke racial divisions to distract Ohioans from the way they are redistributing wealth upward. This is not the natural state of our communities, but the consequence of policy choices.

The policies presented here, if implemented, would reverse decades of decline. It is time to unrig the system. It is time for a new Ohio economy—one that works for all.