What you need to know about Ohio Politics and Policy

Stephen Dyer · February 6, 2017

Five Questions About Kasich’s School Funding Proposal

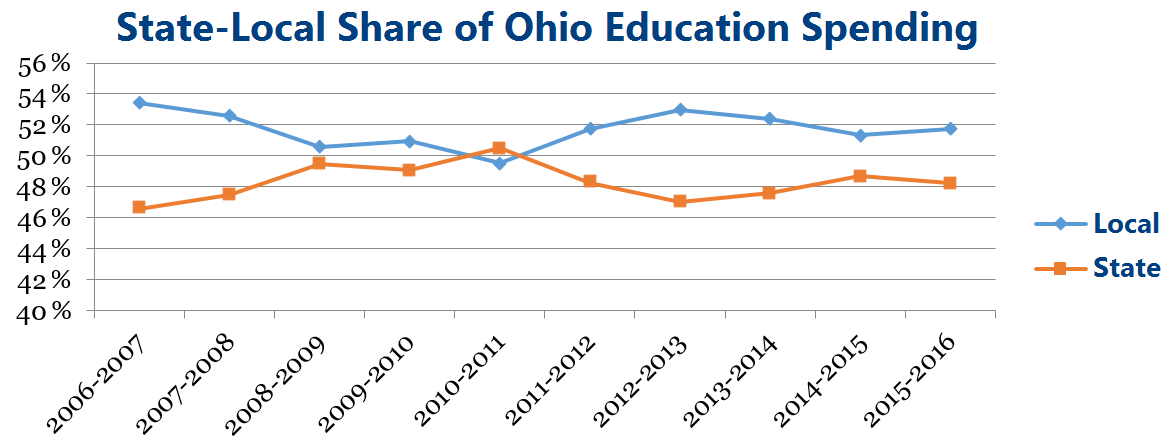

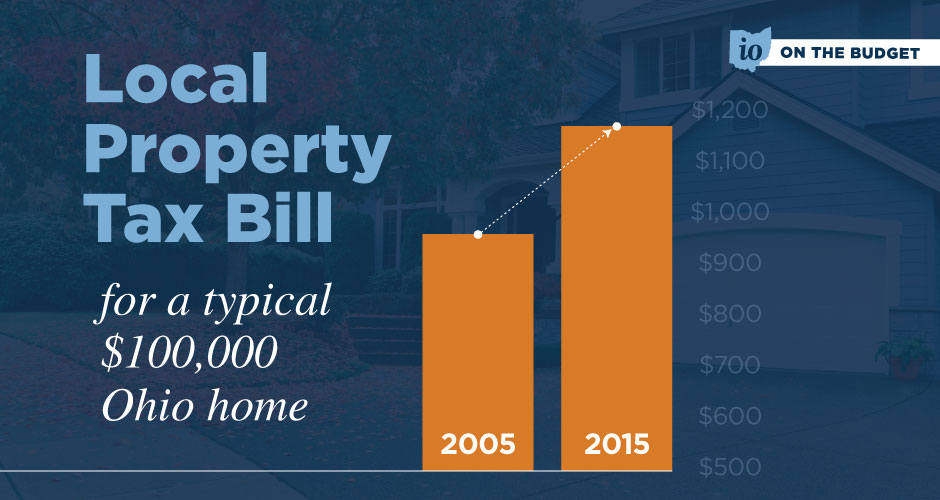

It’s been 20 years since the Ohio Supreme Court first ruled that Ohio’s school funding system was unconstitutional because it didn’t adequately calculate the cost of schooling Ohio children, and relied too much on local property taxes. Since Gov. Kasich took office, the local-state funding disparity has grown after years of shrinking and was even wiped out the year before he took office. Local property taxpayers are now paying more than ever before to fund our kids’ education – the exact opposite of what the Ohio Supreme Court ruled the state needed to do 20 years ago.

Local property taxpayers are now paying more than ever before to fund our kids’ education – the exact opposite of what the Ohio Supreme Court ruled the state needed to do 20 years ago.

Gov. John Kasich’s proposed budget continues to exacerbate the unconstitutional nature of our state’s funding system and we don’t know the full potential cost to kids in our local school districts[1]. Despite that, district by district estimates show that Kasich plans to remove money in vast swaths from kids in Ohio’s most rural, poor districts – 83 percent of whom would be cut under this budget – and give increases to suburban and urban districts.

Gov. John Kasich’s proposed budget continues to exacerbate the unconstitutional nature of our state’s funding system and we don’t know the full potential cost to kids in our local school districts[1]. Despite that, district by district estimates show that Kasich plans to remove money in vast swaths from kids in Ohio’s most rural, poor districts – 83 percent of whom would be cut under this budget – and give increases to suburban and urban districts.

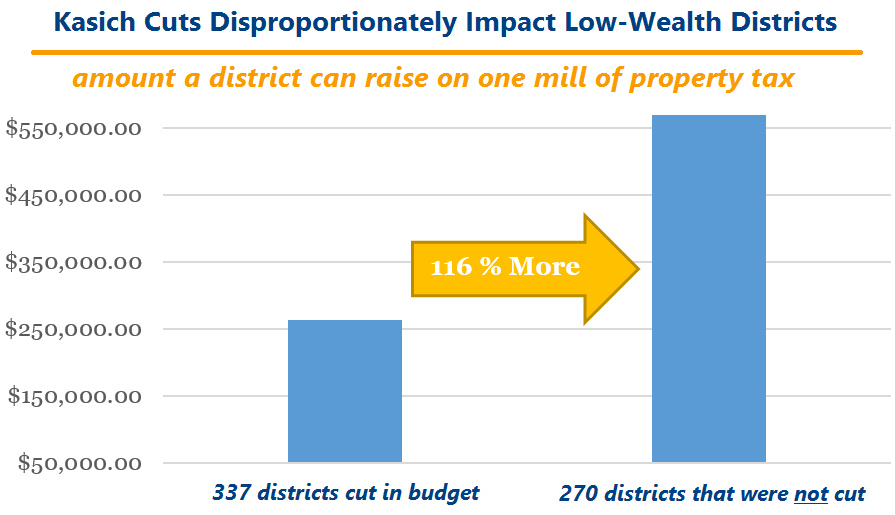

Removing even a little bit of state revenue from rural districts can cause great hardship for those kids because they cannot raise local revenue in the amounts that urban and suburban districts can. For example, the districts receiving flat funding or increases in Kasich’s budget can raise property taxes at 116 percent the rate of districts that received cuts.

Here are 5 questions we’d like to see administration officials answer during tomorrow’s education funding hearing:

Removing even a little bit of state revenue from rural districts can cause great hardship for those kids because they cannot raise local revenue in the amounts that urban and suburban districts can. For example, the districts receiving flat funding or increases in Kasich’s budget can raise property taxes at 116 percent the rate of districts that received cuts.

Here are 5 questions we’d like to see administration officials answer during tomorrow’s education funding hearing:

- How will this budget reduce reliance on property taxes to pay for our kids’ education in all districts, as the Ohio Supreme Court ordered us to do 20 years ago?

- Why weren’t the cuts to tangible personal property tax reimbursements or any potential increases to charters and vouchers included in the district by district estimates?

- Why do 83 percent of Ohio’s rural school districts receive cuts?

- Why was the state guarantee eliminated if population drops 5 percent? Isn’t that awfully low considering a 5 percent drop, especially in smaller districts, might only be a handful of students, which would have a minimal impact on school staffing and infrastructure?

- Why was ability to pay such an important factor in Local Government Funding, but ability to pay seems to not governing the funding going to our 1.8 million school children?

Tagged in these Policy Areas: K-12 Education | Ohio State Budget