What you need to know about Ohio Politics and Policy

Terra Goodnight · January 27, 2017

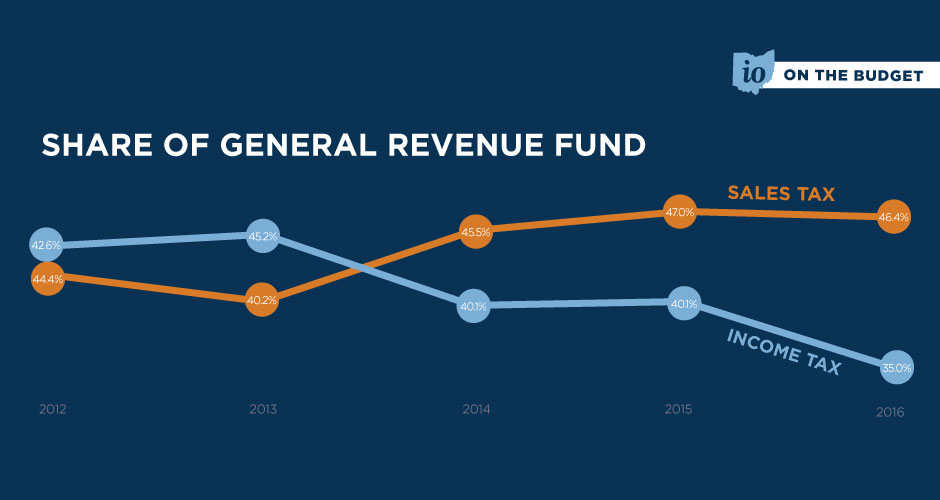

IO on the Budget: Ohio Shifts Tax Burden From Rich to Poor

On Monday, Governor Kasich will unveil his last two-year budget proposal. While details are not yet available, Kasich has said he would like to continue to lower the income tax, paid for by raising the sales tax. If Kasich moves in this direction, it would not be the first time he has proposed cutting the income tax — the state’s most progressive tax, designed so those at the top pay the highest rate — and paying for it with increases in the highly regressive sales tax. Why are sales taxes regressive? People with low-incomes spend much of their income on things that are taxed. As a result, they pay a much larger share of their income on taxes in states with regressive tax systems that rely heavily on sales taxes to fund state spending. According to the Institute on Taxation & Economic Policy, the poorest 20% of Ohioans pay nearly 12 percent of their income on state and local taxes, compared to just 5.5% paid by the top 1%. We crunched the numbers, and here’s how dramatic the shift has been in just six years: Since Kasich took office, the two lines — representing the share of the total cost of funding state government programs — have crossed paths, with the amount contributed via progressive income taxes declining from 44% to 35%. At the same time, regressive sales taxes have steadily increased, from 43 to 46%, and now pick up the largest share of the cost of state government programs.

We’ll be back here Monday with a first look at the Kasich budget for fiscal years 2018-2019.

Since Kasich took office, the two lines — representing the share of the total cost of funding state government programs — have crossed paths, with the amount contributed via progressive income taxes declining from 44% to 35%. At the same time, regressive sales taxes have steadily increased, from 43 to 46%, and now pick up the largest share of the cost of state government programs.

We’ll be back here Monday with a first look at the Kasich budget for fiscal years 2018-2019.

Tagged in these Policy Areas: Ohio State Budget