What you need to know about Ohio Politics and Policy

Terra Goodnight · October 18, 2016

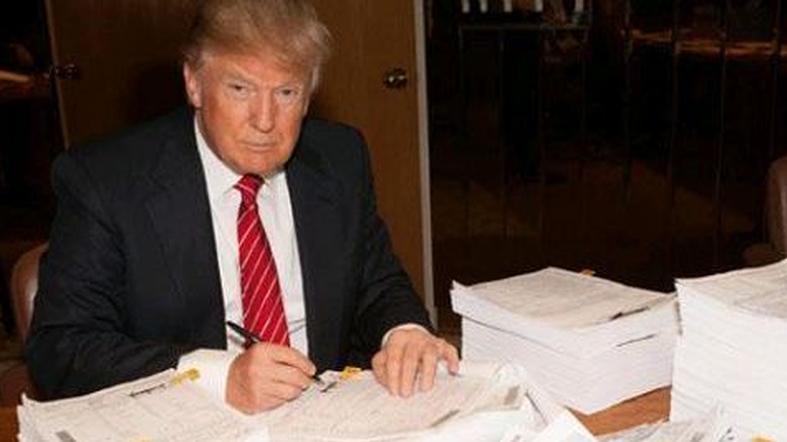

Trump’s Tax Dodge Highlights Ohio Tax Policy That Hurts Communities

If you prefer policy to the scandals and conspiracies that have taken center stage in the Presidential race, let’s briefly revisit the recent revelation that Donald Trump was able to avoid paying income tax for nearly two decades. This move was a result of Trump’s taking a $916 million deduction in 1995 for losses from his various businesses. In yet another example of how the tax code is skewed to favor those at the top, federal tax law allows business owners to subtract what is termed a “Net Operating Loss” (or NOL) from their income when determining tax liability. Unfortunately, this tax trick isn’t limited to federal taxes. Two years ago, Ohio lawmakers rewrote state law to force Ohio cities to allow the same type of tax break for business owners. The result is that cities, which had already been deeply impacted by state funding cuts, have less revenue to deliver essential services like road repair and public safety.

In late 2014, legislators passed a bill – House Bill 5 – that requires cities to allow individuals who report business income on their personal income taxes to allow the deduction of business losses (NOLs) for up to 5 years. This change impacts 234 cities and villages, reducing the amount of revenue they collect to pay for vital public services and creates a new tax breaks for business owners. Ohio cities must allow a deduction of business losses even if the profits they offset came from wholly separate business. Unlike federal law, salary income cannot be offset by NOLs (bad news for any in-state real estate moguls drawing a big salary from popular reality shows!)

The revenue impact to Ohio cities from the policy is expected to be large. While it is hard to predict the impact of a deduction businesses don’t currently claim, some cities offered estimates at the time of HB5’s consideration. Athens projected losing $60,000 per year; Westerville $300,000; Cleveland said it would cut $3 million. We estimated the statewide impact of the law could be as high as $82 million. Today, a legislative task force is currently working to estimate the impact of the law on cities’ bottom lines, but that didn’t stop lawmakers from enacting it into law.

Proponents of even larger NOL tax breaks are still at it. In late September, a witness argued in a bipartisan committee hearing that lawmakers should go much further and force Ohio cities to extend the favorable treatment of tax losses from 5 to 20 years. At the federal level, Speaker Paul Ryan’s House Republican budget blueprint calls for allowing the tax break to grow with inflation and taking them for an unlimited number of years, not just the 18 Trump enjoyed.

Ohio cities are coping with the elimination of the estate tax and cuts in state revenue-sharing and now are dealing with this new major hit on revenue. Further expanding the ability of businesses to shield taxable income for years after experiencing a loss means that individual rate payers have to pay more or local communities will continue to be starved of critical resources needed for public safety and other services.

As local official put it when this state law passed, “If businesses don’t pay, residents will have to.”

Unfortunately, this tax trick isn’t limited to federal taxes. Two years ago, Ohio lawmakers rewrote state law to force Ohio cities to allow the same type of tax break for business owners. The result is that cities, which had already been deeply impacted by state funding cuts, have less revenue to deliver essential services like road repair and public safety.

In late 2014, legislators passed a bill – House Bill 5 – that requires cities to allow individuals who report business income on their personal income taxes to allow the deduction of business losses (NOLs) for up to 5 years. This change impacts 234 cities and villages, reducing the amount of revenue they collect to pay for vital public services and creates a new tax breaks for business owners. Ohio cities must allow a deduction of business losses even if the profits they offset came from wholly separate business. Unlike federal law, salary income cannot be offset by NOLs (bad news for any in-state real estate moguls drawing a big salary from popular reality shows!)

The revenue impact to Ohio cities from the policy is expected to be large. While it is hard to predict the impact of a deduction businesses don’t currently claim, some cities offered estimates at the time of HB5’s consideration. Athens projected losing $60,000 per year; Westerville $300,000; Cleveland said it would cut $3 million. We estimated the statewide impact of the law could be as high as $82 million. Today, a legislative task force is currently working to estimate the impact of the law on cities’ bottom lines, but that didn’t stop lawmakers from enacting it into law.

Proponents of even larger NOL tax breaks are still at it. In late September, a witness argued in a bipartisan committee hearing that lawmakers should go much further and force Ohio cities to extend the favorable treatment of tax losses from 5 to 20 years. At the federal level, Speaker Paul Ryan’s House Republican budget blueprint calls for allowing the tax break to grow with inflation and taking them for an unlimited number of years, not just the 18 Trump enjoyed.

Ohio cities are coping with the elimination of the estate tax and cuts in state revenue-sharing and now are dealing with this new major hit on revenue. Further expanding the ability of businesses to shield taxable income for years after experiencing a loss means that individual rate payers have to pay more or local communities will continue to be starved of critical resources needed for public safety and other services.

As local official put it when this state law passed, “If businesses don’t pay, residents will have to.”

Tagged in these Policy Areas: