What you need to know about Ohio Politics and Policy

Terra Goodnight · February 12, 2013

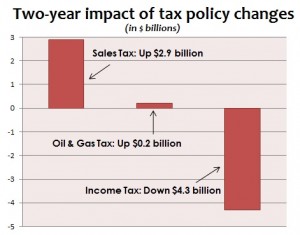

State budget includes massive shift from income to sales taxes

The two-year state budget announced last week includes a proposed to massively shift the cost of paying for government away from the income tax – the state’s most progressive tax, based on one’s ability to pay – toward more reliance on the sales tax. Here are the specific components of the plan: Sales tax: net tax increase of $2.9 billion- Expand the sales tax to cover all “non-essential” services individuals and businesses purchase: raises $4.4 billion

- Lower the sales tax rate from 5.5 to 5 percent: costs $1.5 billion

- Lower income tax rates in all brackets by 20 percent over 3 years: costs $3.1 billion

- Allow businesses to deduct half their income from the newly-reduced rates: costs $1.2 billion

- For horizontal wells, increases the tax on oil extracted from $.20/barrel to 4%; converts tax on natural gas from $.03/MCF to 3%; waives all taxation for first year of operation: raises $200 million

Tagged in these Policy Areas: Ohio State Budget