What you need to know about Ohio Politics and Policy

Commentary: Kasich’s Tax Cut Is No Job Creator

Like the gambling addict who claims he’s buying lottery tickets to “help schools and the kids” Gov. Kasich wants to sell us on a delusion. Take his plan to cut small business taxes by 50%.

Please.

The Governor says it’s all about job creation. “Small businesses,” he endlessly intones, “are the job creators in this state.” If we just cut their taxes by 50%, a virtual tsunami of hiring is sure to follow.

Just one small problem.

According to the Cleveland Plain Dealer, less than 2% of Ohio’s 717,000 small-business owners who qualify for the cut would save enough to hire even one minimum wage worker. In fact, 80% of Ohio’s small businesspeople would get less than $400 per year.

400 bucks a year? How many workers can you hire with that?

But what about all those small businesses that are, as the Governor likes to say, “pass through entities” — meaning that their business income “passes through” to their personal income tax calculations? Here comes that darned 80% figure again. Turns out that fully 80% of Ohio’s “pass through entities” have only a single employee. They’re lawyers, doctors, real estate agents and other one-person operations. In other words, they’re not “job creators.” So they’ll probably just pocket their tax cut instead.

Who else will benefit from Kasich’s 50% small business tax cut? Unfortunately, not the Mom & Pop operations most of us think of as “small businesses”; as we now know, they’d save a few hundred dollars a year at most.

But under the Kasich plan, “small” businesses with taxable income up to of $750,000 per year would also qualify. And how many Ohio small businesses generate taxable income of $750,000 per year? Why, about 1%.

What an unexpected surprise! It’s almost like Republicans have a thing for the 1%. And not just when it comes to small businesses.

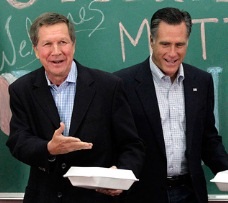

Last November, Mitt Romney — who practically personified the 1% — tried to sell the country on a federal income tax cut that would mostly help folks like himself. Let’s just say it didn’t turn out well for Mitt.

But now here comes Gov. Kasich four months later with his let’s-cut-the-state-income-tax-and-impose-a-sales tax-on-more-items plan at the state level.

And what do you know? An independent analysis by the Cleveland think tank Policy Matters Ohio found that the Kasich plan would result in an annual tax cut of over $10,000 per year for the richest 1%, while middle and lower income Ohioans would get a net tax increase.

So whether we’re talking about Gov. Kasich’s proposed 50% tax cut for small business, or his tax plan for individual Ohioans, the dynamic never changes. Help the rich. Forget the rest. It’s a wonderfully Republican sentiment. Just don’t confuse it with a plan to create new jobs.

Like the gambling addict who claims he’s buying lottery tickets to “help schools and the kids” Gov. Kasich wants to sell us on a delusion. Take his plan to cut small business taxes by 50%.

Please.

The Governor says it’s all about job creation. “Small businesses,” he endlessly intones, “are the job creators in this state.” If we just cut their taxes by 50%, a virtual tsunami of hiring is sure to follow.

Just one small problem.

According to the Cleveland Plain Dealer, less than 2% of Ohio’s 717,000 small-business owners who qualify for the cut would save enough to hire even one minimum wage worker. In fact, 80% of Ohio’s small businesspeople would get less than $400 per year.

400 bucks a year? How many workers can you hire with that?

But what about all those small businesses that are, as the Governor likes to say, “pass through entities” — meaning that their business income “passes through” to their personal income tax calculations? Here comes that darned 80% figure again. Turns out that fully 80% of Ohio’s “pass through entities” have only a single employee. They’re lawyers, doctors, real estate agents and other one-person operations. In other words, they’re not “job creators.” So they’ll probably just pocket their tax cut instead.

Who else will benefit from Kasich’s 50% small business tax cut? Unfortunately, not the Mom & Pop operations most of us think of as “small businesses”; as we now know, they’d save a few hundred dollars a year at most.

But under the Kasich plan, “small” businesses with taxable income up to of $750,000 per year would also qualify. And how many Ohio small businesses generate taxable income of $750,000 per year? Why, about 1%.

What an unexpected surprise! It’s almost like Republicans have a thing for the 1%. And not just when it comes to small businesses.

Last November, Mitt Romney — who practically personified the 1% — tried to sell the country on a federal income tax cut that would mostly help folks like himself. Let’s just say it didn’t turn out well for Mitt.

But now here comes Gov. Kasich four months later with his let’s-cut-the-state-income-tax-and-impose-a-sales tax-on-more-items plan at the state level.

And what do you know? An independent analysis by the Cleveland think tank Policy Matters Ohio found that the Kasich plan would result in an annual tax cut of over $10,000 per year for the richest 1%, while middle and lower income Ohioans would get a net tax increase.

So whether we’re talking about Gov. Kasich’s proposed 50% tax cut for small business, or his tax plan for individual Ohioans, the dynamic never changes. Help the rich. Forget the rest. It’s a wonderfully Republican sentiment. Just don’t confuse it with a plan to create new jobs.

Tagged in these Policy Areas: Ohio State Budget