- The median income in Marietta remains nearly $10,000 less than the statewide average, and 25 percent of Marietta residents – and nearly 4 in 10 children – live below the poverty line.

- The workforce in Marietta has shrunk by 5 percent over the last five years, declining from 6,868 in 2010 to 6,505 today.

- The bottom 20% of income earners in Marietta have seen state taxes increase as a result of a shift to a more regressive tax code.

- Medicaid expansion has resulted in over 3,000 Washington County residents gaining access to health care.

- State funding cuts have resulted in a nearly $1 million annual revenue loss to Marietta, an 11 percent reduction from the city’s 2010 budget.

- Marietta schools have lost $1.7 million (adjusting for inflation) in state aid since 2010, while local property taxes have increased 22 percent.

A Closer Look: The Kasich Record on Public Education

Research Overview

As Gov. John Kasich looks ahead to the White House, we took a look back at his record on one of the most critical areas of responsibility for his gubernatorial leadership – primary and secondary education. This report examines various Kasich administration policies championed during his tenure and what the impact has been on schools, communities, and most importantly Ohio’s 1.8 million school children. [Read more…]Please Join us For a Fundraising Reception

We hope you’ll join us to support the work of Innovation Ohio Women’s Watch Initiative

Now is more important than ever to support the work of our Women’s Watch Initiative as we work to push back against extreme legislation that is harmful to women. We hope that you will stand with us as we continue our efforts to advocate for the rights and equality of Ohio’s women.

RSVP BY PHONE: To Erin Ryan at (440) 382-2900

RSVP BY MAIL: Please make your check payable to and mail to: Innovation Ohio Education Fund | 35 E. Gay Street, Suite 260, Columbus, OH 43215

RSVP ONLINE: Please send an email to ryan@innovationohio.org let us know you will be attending and click here to submit your contribution online.

Senator Portman Must Reconsider ‘Yes’ Vote on TPP Fast Track

As the US Senate passes a bill allowing for fast tract authority on the controversial trade deal titled the Trans-Pacific Trade Partnership (TPP), Ohio finds itself, once again, on the brink of possibly damaging economic consequences. The TPP is a free trade agreement between 12 Pacific Rim nations and is said to offer opportunities for economic growth in America and strategic leadership in Asia.

Republicans like Rob Portman hope to force the deal through to the President’s desk this week but have failed to mention its possible harmful ramifications for states like Ohio. Instead, Mr. Portman chooses to focus on campaign donations from pro-trade lobbies. Preceding the May 23rd vote to fast track TPP, Senator Portman claimed almost $120,000 in campaign donations from the US Business Coalition for TPP.

One only need to look back at the consequences of past free trade agreements to realize that the damage that future deals could cause for Ohio and America’s hard working middle class families far supersedes collections of campaign financing.

The North American Free Trade Agreement (NAFTA), for example, played a significant part in the loss of 323,308 manufacturing jobs in Ohio and nearly 5 million manufacturing jobs nationally. Furthermore, private sector manufacturing jobs in Ohio have declined from 23.4 percent to 14.9 percent in the NAFTA era.

Remaining manufacturing jobs and other similar paying positions were subject to trends of wage suppression. A report from the Economic Policy Institute suggests that increased free trade from NAFTA like deals has suppressed the wages of non-college educated workers around $1,800. Free trade has similar effects on small family farms with 12,000 small-scale farms going out of business since NAFTA’s implementation.

Consequences such as these cannot be ignored and our representatives in Washington D.C. must strive to acquire a better deal for middle class Americans.

While we can’t avoid international trade and the modern global economy, representatives like Mr. Portman must work harder to negotiate trade deals that do not crush middle class Americans instead of working to please pro-trade campaign donors. We therefore encourage Mr. Portman to revoke his support for the TPP and consider the ramifications of increased free trade on middle class America.

As the US Senate passes a bill allowing for fast tract authority on the controversial trade deal titled the Trans-Pacific Trade Partnership (TPP), Ohio finds itself, once again, on the brink of possibly damaging economic consequences. The TPP is a free trade agreement between 12 Pacific Rim nations and is said to offer opportunities for economic growth in America and strategic leadership in Asia.

Republicans like Rob Portman hope to force the deal through to the President’s desk this week but have failed to mention its possible harmful ramifications for states like Ohio. Instead, Mr. Portman chooses to focus on campaign donations from pro-trade lobbies. Preceding the May 23rd vote to fast track TPP, Senator Portman claimed almost $120,000 in campaign donations from the US Business Coalition for TPP.

One only need to look back at the consequences of past free trade agreements to realize that the damage that future deals could cause for Ohio and America’s hard working middle class families far supersedes collections of campaign financing.

The North American Free Trade Agreement (NAFTA), for example, played a significant part in the loss of 323,308 manufacturing jobs in Ohio and nearly 5 million manufacturing jobs nationally. Furthermore, private sector manufacturing jobs in Ohio have declined from 23.4 percent to 14.9 percent in the NAFTA era.

Remaining manufacturing jobs and other similar paying positions were subject to trends of wage suppression. A report from the Economic Policy Institute suggests that increased free trade from NAFTA like deals has suppressed the wages of non-college educated workers around $1,800. Free trade has similar effects on small family farms with 12,000 small-scale farms going out of business since NAFTA’s implementation.

Consequences such as these cannot be ignored and our representatives in Washington D.C. must strive to acquire a better deal for middle class Americans.

While we can’t avoid international trade and the modern global economy, representatives like Mr. Portman must work harder to negotiate trade deals that do not crush middle class Americans instead of working to please pro-trade campaign donors. We therefore encourage Mr. Portman to revoke his support for the TPP and consider the ramifications of increased free trade on middle class America. Boston Passes the City’s First Ever Paid Parental Leave Policy

In a press release from the Mayor’s office, Walsh stated that passing this policy “is not only the right thing to do but it is important to the vitality and economy of our city. The benefits of this policy to both individuals and organization are a win-win and it is my hope that businesses will follow our lead and extend this benefit to their employees.”

The policy allows City of Boston employees (male and female, as well as same-sex couples) who have worked for the City for at least one year, to take up to six weeks of Paid Parental Leave during a 12-month period following the birth or adoption of a child/children. Pay during the period of leave is structured to provide 100 percent during the first two weeks, 75 percent during the third and fourth week, and 50 percent for weeks five and six.

Read Innovation Ohio’s Report: “The Benefits of Paid Parental Leave”

In a press release from the Mayor’s office, Walsh stated that passing this policy “is not only the right thing to do but it is important to the vitality and economy of our city. The benefits of this policy to both individuals and organization are a win-win and it is my hope that businesses will follow our lead and extend this benefit to their employees.”

The policy allows City of Boston employees (male and female, as well as same-sex couples) who have worked for the City for at least one year, to take up to six weeks of Paid Parental Leave during a 12-month period following the birth or adoption of a child/children. Pay during the period of leave is structured to provide 100 percent during the first two weeks, 75 percent during the third and fourth week, and 50 percent for weeks five and six.

Read Innovation Ohio’s Report: “The Benefits of Paid Parental Leave” Review Finds Women Not Getting Coverage Required by ACA

Women may not be getting the health coverage they were guaranteed by the Affordable Care Act, according to a new report by by the National Women’s Law Center, and the Obama administration has warned carriers that the practice must stop.

The April report outlined numerous violations by insurers in 15 states, including Ohio, which included excluding dependents from maternity care, limits on breastfeeding services and a failure to provide preventive services and contraception without co-pays or deductibles.

Late last month, I joined a panel on Capitol Hill to discuss Innovation Ohio’s partnership with NWLC to address shortcomings in plans offered in Ohio in 2014. Our work led to multiple plans modifying their policies for 2015, but the report found that, despite our work, many violations of the law can still be found in policies sold on the Ohio exchange.

The Ohio Department of Insurance, the state agency charged with reviewing and certifying plans for sale on the health exchange and that is headed by Lieutenant Governor Mary Taylor, was notified of the violations but did not respond.

Late last month, I joined a panel on Capitol Hill to discuss Innovation Ohio’s partnership with NWLC to address shortcomings in plans offered in Ohio in 2014. Our work led to multiple plans modifying their policies for 2015, but the report found that, despite our work, many violations of the law can still be found in policies sold on the Ohio exchange.

The Ohio Department of Insurance, the state agency charged with reviewing and certifying plans for sale on the health exchange and that is headed by Lieutenant Governor Mary Taylor, was notified of the violations but did not respond.

The report was covered by the New York Times, National Public Radio and the Wall Street Journal (subscription required). Following the report’s release, the Obama administration has issued new guidance to insurance carriers that they must cover all FDA-approved forms of contraception without co-pays or deductibles and provide other preventive services to women without cost-sharing.

A report on the coverage of women’s health services by Ohio insurers, including the results of a second review of plans offered in 2015, will be released in the coming weeks.

The report was covered by the New York Times, National Public Radio and the Wall Street Journal (subscription required). Following the report’s release, the Obama administration has issued new guidance to insurance carriers that they must cover all FDA-approved forms of contraception without co-pays or deductibles and provide other preventive services to women without cost-sharing.

A report on the coverage of women’s health services by Ohio insurers, including the results of a second review of plans offered in 2015, will be released in the coming weeks.

IO Analysis: The Benefits of Paid Parental Leave

The United States falls behind the rest of the world in providing workers with guaranteed paid parental leave. Only 13% of U.S. workers enjoy paid family leave benefits, and the number is much lower — 4% — among low-wage workers. Workers without access to paid leave are more likely to leave the workforce, stay out of work far longer, in many case relying on public assistance, costing taxpayers and the local economy all while reducing family economic security.

In Ohio, women make up nearly half of the state’s labor force. Paid parental leave policies are a critical way to keep our workforce and local economy strong. Our latest research looks at the state of paid parental leave and the many benefits it can offer.

The United States falls behind the rest of the world in providing workers with guaranteed paid parental leave. Only 13% of U.S. workers enjoy paid family leave benefits, and the number is much lower — 4% — among low-wage workers. Workers without access to paid leave are more likely to leave the workforce, stay out of work far longer, in many case relying on public assistance, costing taxpayers and the local economy all while reducing family economic security.

In Ohio, women make up nearly half of the state’s labor force. Paid parental leave policies are a critical way to keep our workforce and local economy strong. Our latest research looks at the state of paid parental leave and the many benefits it can offer.

Research Highlights

Paid parental leave policies have many benefits for women, families, employers and society as a whole. Among them include:Strengthens Women and Families

- The majority of young children depend on the income of working mothers, who are increasingly likely to be sole or primary breadwinners in their families. Paid maternity and paternity leave policies preserve income and increase health outcomes for women and their dependent children.

Reduces Gender and Economic Disparities

- When taking leave without pay is the only option for a new parent, unmarried, nonwhite and less educated parents are the least likely to make use of this benefit. This relatively low level of leave-taking by less advantaged workers can create health and economic disparities for parents and children.

Improves Critical Health Outcomes

- Longer leaves that result from the availability of paid time off have been shown to improve the health prospects of women and their babies. Rates of infant mortality, immunization and breastfeeding have all been seen to improve when women have access to paid leave during pregnancy and after childbirth.

Positive Impacts on the Local Economy

- Paid leave policies for mothers and fathers increase the level of women’s employment and participation in the regional workforce, and contribute to higher levels of employment rates and wages for mothers in the years following childbirth. And by preserving family income, these policies also reduce demand for public assistance and social services.

A Stronger, More Productive Workforce

- Paid leave policies have numerous benefits for local employers by improving employee retention, job satisfaction, and productivity and helping employers compete for top talent.

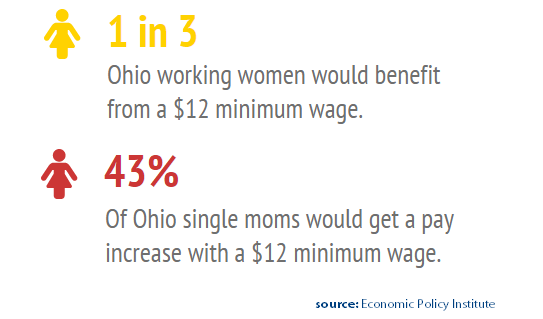

Minimum Wage Proposal Would Help Ohio Women and Families

Raising the wage has the additional benefit of reducing reliance on public assistance. The UC Berkeley Labor Center estimates that taxpayers spend nearly $153 billion each year on public support for workers making poverty wages. Over half of fast-food workers or their dependents are enrolled in one of four major public assistance programs.

Download: Economic Policy Institute’s Ohio Minimum Wage Fact Sheet

Raising the wage has the additional benefit of reducing reliance on public assistance. The UC Berkeley Labor Center estimates that taxpayers spend nearly $153 billion each year on public support for workers making poverty wages. Over half of fast-food workers or their dependents are enrolled in one of four major public assistance programs.

Download: Economic Policy Institute’s Ohio Minimum Wage Fact Sheet

Take Action to Support Paid Family Leave

The U.S. is one of only 3 countries in the world with no legal right to paid time off work for pregnancy, childbirth and infant care. Only half of U.S. Workers are eligible for time off without pay. As a result of the lack of a national policy, only 13 percent of workers enjoy any paid family leave benefits through their employers.

Last week, Senator Kirsten Gillibrand introduced the Family and Medical Insurance Leave (FAMILY) Act, an insurance program funded by payroll deductions that would fund paid time off for all workers, regardless of where they work. Ohio Senator Sherrod Brown has signed on as a cosponsor of S.786, but to date, Senator Rob Portman has not taken a position.

Ohio families shouldn’t have to choose between a paycheck and caring for a loved one. Sign our petition to tell Senator Portman to sign on as a cosponsor of the FAMILY Act and support Ohio’s working families.

The U.S. is one of only 3 countries in the world with no legal right to paid time off work for pregnancy, childbirth and infant care. Only half of U.S. Workers are eligible for time off without pay. As a result of the lack of a national policy, only 13 percent of workers enjoy any paid family leave benefits through their employers.

Last week, Senator Kirsten Gillibrand introduced the Family and Medical Insurance Leave (FAMILY) Act, an insurance program funded by payroll deductions that would fund paid time off for all workers, regardless of where they work. Ohio Senator Sherrod Brown has signed on as a cosponsor of S.786, but to date, Senator Rob Portman has not taken a position.

Ohio families shouldn’t have to choose between a paycheck and caring for a loved one. Sign our petition to tell Senator Portman to sign on as a cosponsor of the FAMILY Act and support Ohio’s working families. - 1

- 2

- 3

- …

- 45

- Next Page »